Here is the ultimate guide to help you maneuver Helb Student Portal Login, Helb Registration, Helb loan application process, how to check your helb loan status, where to get helb application form and even get helb clearance certificate..

If you are a beneficiary of HELB, you probably know what this institution does. But if this is a new name to you, the article is absolutely for you.

Over many years, HELB (Higher Education Loans Board) has been committed to empowering the dreams of students and making them come true. Its key role is to offer financial support to applicants who want to undertake tertiary education.

What this means is that as long as you completed your high school studies, and you passed the KUCCPs cut-off mark for a place in the public/private university or college, then HELB Kenya has a good enough token in the form a loan for the whole period of study.

You will be required to repay this loan with a small interest after you complete your studies.

What is HELB?

HELB is a financial institution that supports students by offering them loans to finance their studies. It could be that you are heading to a university or a TVET institution but you’re honestly unsure where the tuition fees will come from.

For those students whose parents are not particularly in the position to back them up financially in their tertiary education, it’s always going to be a difficult journey.

This can be stressing, draining and even discouraging. Especially after the hard work you put in your secondary studies.

Fortunately, this is where HELB comes in. To help you afford your studies.

What Are The Available HELB Products.

Just like other loan financiers, HELB comes with a number of loan products for the Kenyan citizens/students. According to the HELB portal, the following are some of the most common products offered by the institution.

1. Undergraduate Loan

This loan product is available for students who are joining public or private universities in the East African Community. You can get this loan whether you are a government-sponsored student or a self-sponsored student coming directly from high school.

The exact amount awarded ranges between Kshs. 40,000 to Ksh. 60,000 per year; to mean that the bare minimum is Ksh.40000 and the maximum being Ksh.60000. And this award depends on the extent of your neediness.

The interest rate is unbelievably low at 4 percent per annum. Repayment of this loan is after completing your studies.

You should ensure that you apply at least a month earlier before learning commences. This is key for timely processing and disbursement of your loan.

There are two different types of undergraduate loan application:

- First Time Application

This loan is available for those students who are applying for the time first ever. You can apply for this loan through the student portal – Higher Education Loans Board.

- Second and Subsequent Application

These feature all second and subsequent applications. Depending on your program duration, you could apply for the second, third or fourth time.

Undergraduate loans are offered to support students in the following key areas: tuition fee, purchase of books and other stationery and accommodation and subsistence needs.

So, do not think that this loan includes money for your leisure or luxury life. Neither is it to help you sort other family obligations as you may find yourself in the same financial incapacitation you were in before.

How is the Helb Loan Disbursed?

As said before, you are either awarded Ksh.40K as the minimum or Ksh.60K as maximum. However, you can be given anything within that range.

Once you have successfully applied (because again this not a guarantee), the government-sponsored students’ loan amount is split to cater for tuition and upkeep.

What happens here is that the tuition money which is always Ksh.8000 for two semesters is deducted and sent to the university directly. The rest is disbursed into your bank account for upkeep.

Note that if you are lucky, you could also get a small HELB bursary between Ksh.4000 – Ksh.8000 per year. But only for the extremely needy students.

2. Jielimishe Loan

A jielimishe loan is available for the continuing students i.e. the employed students who would like to continue with their studies in order to obtain a degree.

It is only limited to the employees of selected companies who are pursuing any given degree program within the country. The loans are offered yearly and if you succeed to get, the amount will be deposited to your respective learning institution.

Unlike the undergraduate loans, repaying this loan begins just after the first month of disbursement. You are deducted from the payroll each month on the basis of the check-off system for 4 years.

An interest of 12 percent applies to all loans. And you also supposed to pay annual ledger fee of Ksh.1000.

Find out eligibility, requirements and application procedure at helb.co.ke.

Related Post: Nemis Portal registration and Login

3. TVET Loans

The third category of the HELB products are the TVET loans. These are loans offered to students who want to pursue Diploma and Certificate courses in the public universities, public national polytechnics, Institutes of Technology and the Technical Training Institutes.

Applications for this loans takes place between January and April every year. Make sure that the institution you’ve chosen to study is funded by HELB to avoid frustrations.

Click this link to apply.

4. HELB Postgraduate Scholarship

For students wishing to further their education to the masters or PHD levels, HELB provides special scholarships for such. So long as you want to study within the country.

This scholarship is partial; the master’s students receive Ksh.200000 and Ksh.450000 for Ph.D. programs. Find out the application criteria and guidelines here.

Know that you’ll be required to pay a non-refundable application fee of Ksh.3000 directly to HELB operations account number 1104823047 KCB University Way Branch. NOT to a person!

Note that besides these products, HELB has partnered with a number of other education stakeholders including the Government of Kenya to start key programs. A good example of those programs include:

- Training Revolving Fund (TRF)

- Afya Elimu Fund

- HELB universities partnerships

- Visa Oshwal Scholarships

HELB Student Portal Guide: How to Register with HELB.

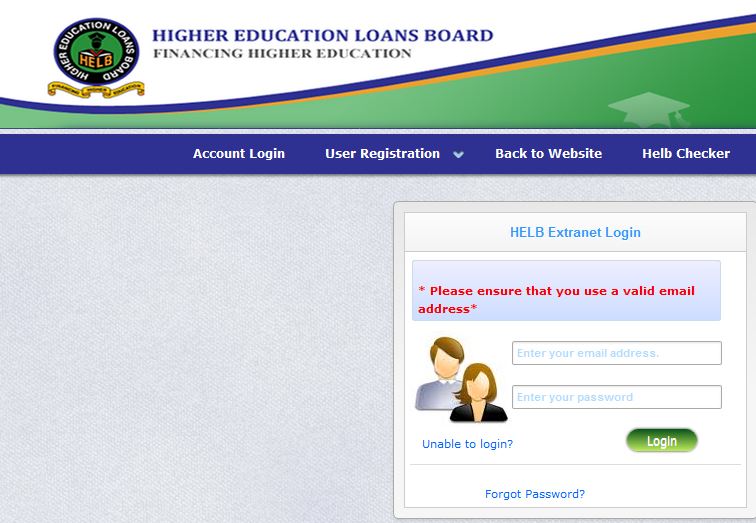

It is compulsory to register with HELB in order to enjoy the products they provide. Here is a quick guide to the HELB registration process:

- Open a web browser: Chrome, Mozilla or opera.

- Visit the HELB loan portal, which is helb.co.ke

- Select a product and click on it. You will be directed to the HELB student portal.

- Select REGISTER and enter the required information in the given fields. For example, Names, ID number, Valid Email Address, Password.

- Then press on the SIGNUP button. You will receive an activation link to your registered email.

- Log in to your email and click on the HELB portal activation link

- You will be redirected to the HELB page

- Log into your personal account using the email and password you registered with

- Enter your personal and residence details and save

- After that, you can go ahead and apply for the product you want.

HELB Student Portal: Requirements For HELB Loan Applications.

Make sure that the following documents are available when applying for the HELB loan.

- National ID card copy

- Valid bank account for crediting the money (National bank, KCB, Cooperative Bank of Kenya, Postbank and Equity)

- KRA PIN

- Your Parents’ or Guardians’ particulars

- Death Certificate if you are an orphan

- Copy of letter of admission to the learning institution

- Copies of two guarantors’ ID cards

- Three colored passport size photographs

HELB Student Portal: Application Forms.

All application forms can be accessed by clicking on HELB portal student login. You are redirected to the main page of the website.

While on this page, there are several different application forms representing different products. So, you can always choose the application form that suits your description.

Here are the application forms for the non-salaried applicants:

- Undergraduate First Time Applicants

- Undergraduate Second and Subsequent

- Undergraduate Loan Review/Appeals

- Constituency Loan Application Forms Embu

- Constituency Loan Application Forms Tinderet

- Constituency Loan Application Forms Naivasha

- Constituency Loan Application Forms Igembe

- Constituency Loan Application Forms Karachuonyo

- Constituency Loan Application Forms Awendo

- TVET for Tertiary Institutions

- TVET for Tertiary Institutions Second and Subsequent

- Afya Elimu Fund (AEF) Subsequent Loan Application

- First Time and Subsequent Afya Elimu Fund Pre-Service

- Visa Oshwal Scholarship

Here are application forms for salaried applicants you’ll find:

- Alternative Loans for Undergraduate, Salaried Applicants

- Alternative Loans for Postgraduate, Salaried Applicants

- Postgraduate Scholarship

- Training Revolving Fund (TRF) for Civil Servants

- KRA Staff Loan Application Form

What is the Application Process for the HELB Loan?

- Go to the official website helb.co.ke

- You will be asked to go through all of the HELB Financial Literacy guidelines

- On the HELB loan portal, you will be required to select the application form you need and fill in the required fields

- Download and print two copies of the filled in application

- The two copies will need to be carefully filled, signed and stamped by the relevant authorities and guarantors

- Append your signature on the application form and remember to attach all the required documents

- The last page of application form has the list of the documents you are supposed to attach

- Send a properly filled copy of the application form with all the required attachments to one of the following HELB offices: Nairobi, Kakamega, Eldoret, Eldoret, Nakuru, Mombasa, Kisumu, Nyeri, Embu, Machakos, Kisii, Bungoma, Turkana, Meru, Kitui, Kericho, Nandi, Thika, Garissa, Migori, Chuka and Kitale.

- The application shall be picked from these offices and delivered to the HELB head office in Nairobi.

- Alternatively, take the forms yourself to the HELB Student Center on Mezzanine One[M1], Anniversary Towers, University Way, Nairobi.

- Keep the second copy of the application at home

After application, you can be checking for the helb loan status on the helb student portal regularly to find out if the money has been disbursed or not.

HELB Loan Repayment.

If you are an undergraduate, you can start repaying your loan after completing the first two semesters or terms of learning. The HELB postgraduate loans and those for the continuing students can be repaid immediately after disbursal.

Other than that, after completing your studies, you are afforded a grace period of one fiscal year. Afterward, you are supposed to start paying your loan.

Failure to which you face a helb loan repayment penalty of Ksh.5000 every month.

HELB Loan Repayment Options.

1. Bank Payment

Use the following means to submit your payment through the bank: crossed cheque, bankers draft, direct transfer, standing order, EFT or cash deposit to the HELB collection Account numbers as follows:

- Citibank, Nairobi A/C No. 300 040 012

- Co-operative Bank, University way A/C No. 011-296 122 2800

- Barclays Bank, Barclay’s plaza A/C No. 077-501 8216

- Kenya Commercial Bank, University-way A/C No. 1103 266 314

- Standard Chartered Bank, Koinange street A/C No. 010 801 826 4700

- Equity Bank A/C No. 055-029 357 3408

- National Bank of Kenya Harambee Avenue A/C No.010 016 039 1100

2. MPESA Paybill Number Payment

HELB business Number is 200800

You can repay the loan through the Mpesa pay bill shown above.

- On your Mpesa Menu, choose the pay bill option

- Enter 200800 as the playbill

- Enter your national ID number as the ACCOUNT NUMBER

- Put in the amount to repay

- Input your PIN

- Confirm transaction

After paying, it will take 2 business days to have the payment reflected in your helb loan repayment statement.

HELB Loan Clearance

Once you finish paying the loan in full, you can get a HELB clearance certificate from HELB.

You will get this certificate by first, application through filling in the Loan Recovery Enquiry form. Then email this form to certificate@helb.co.ke and don’t forget to include your national ID number.

In Conclusion

If you read to the end, you’re probably richer with the information about HELB loans. Whether you are a newbie waiting to join a college or a leaver looking to start corporate life.

Sometimes, it’s embarrassing to realize that you failed to do the right thing because you didn’t know. And it happens when it comes to matters HELB.

Remember, you want to do everything correctly to get the loan and study stress-free. You want also to repay and live stress-free.