The mobile lending craze in Kenya is probably at its highest point today, owing to the challenging economic times. However, the biggest beneficiaries are mobile lenders, and one of them is Wakanda Credit through its carefully packaged Kashway loan app.

Promising quick and seamless unsecured MPESA loans, Kashway has become a dependable lender for those with good credit scores and payment history. Its mobile loans range from Ksh 500 to about Ksh 50,000, and the lender promises a 91-180 payment tenure.

But like every other mobile lender, Kashway’s most extensive reaping getaways are the interest and service charges. It enjoys a 30-72% APR depending on the amount you borrow and a flat service charge of 22%.

You probably have many questions on issues like eligibility, application requirement, data security, and payments, among others – right?

If so, then I’ll help you answer all of them in this Kashway review. But first, here is a table overview of what to expect from Kashway:

| App Download | Google Play |

| Service Fee | 22 % |

| Lowest Limit | Ksh 500 |

| Highest Limit | Ksh 50,000 |

| Annual Percentage Rate (APR) | 30 – 72% |

| Repayment Period | 91 – 180 days |

| Penalty Fee | 2% of the principal amount |

| Age Limit | 18 years and above |

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

Kashway Loan App Eligibility Requirements

Before you can download and apply for a loan with Kashway, you must meet these requirements:

- Own an Android smartphone with internet access

- Have a registered Safaricom line and an active MPESA account

- Be 18 years and above

- Have a valid Kenyan ID

Kashway Loan App Download

Kashway is available for download on Google Play. All it takes to download it is an internet-enabled Android smartphone. Unfortunately, Kashway is not available in the APP Store, and neither does it offer the USSD code alternative, limiting Kabambe users.

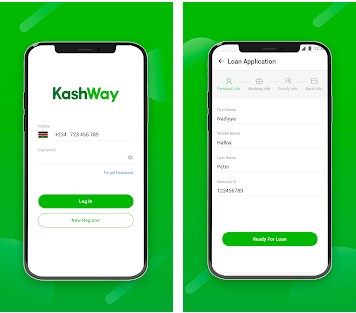

Kashway Account Registration

Once you download the loan app, you can use the steps below to sign up for a Kashway account:

- Install and launch Kashway on your android phone

- Enter your Safaricom number and confirm the number before creating a 4-digit PIN

- Grant Kashway permission to your SMS, phone, contacts, call logs, camera, photos, mobile storage, calendar, phone ID, Wi-Fi connection, and device location.

- Fill out the Kashway loan application form, indicating your names (as per your ID), gender, date of birth, marital status, ID number, and valid email address

- Then provide two emergency contacts and state the relationship between you and them

- Lastly, agree to Kashway terms and conditions to complete the signup

How Can I Apply for Kashway Loan?

Upon successful registration, you can go ahead and apply for a Kashway loan using the steps below:

- Log in to your Kashway account

- Wait for Kashway to display the amount you qualify for

- Tap on “apply now.”

- Wait for disbursement to your MPESA, which takes a few minutes

Please note that you cannot apply for a loan that exceeds the amount you qualify for. However, you can apply for a lower amount according to your financial needs.

Kashway Loan Limits

Kashway loans you Ksh 500 to Ksh 50,000, depending on your creditworthiness, the history you enjoy with the lender (if any), and your overall MPESA dealings.

The more you use MPESA and deal with ‘heavy transactions,’ the likelier you will get a higher limit.

Asking why?

Kashway requests access to your phone’s SMSs as part of the application requirement. So, they can see your transactions unless you delete the messages. But overall, if you are new to Kashway, you should expect to start with a lower amount and grow your limit steadily.

Kashway Loan Interest Rate

Kashway loans attract an Annual Percentage Rate (APR) of 30% – 72%. Other Kashway loan rates include a 22% loan processing charge and a 2% daily penalty for failing to pay your mobile loan on time.

How to Pay Kashway Loan

Kashway expects prompt loan payments. Even better, you can make partial payments before the due date.

When repaying, you need to follow the steps below:

- Go to the MPESA menu and choose Lipa na MPESA

- Select the pay bill option and opt for business number

- Enter Kashway paybill number 900068

- Input your Safaricom number (the one you requested and received the loan with) as the account number

- Enter the amount you want to pay

- Input your MPESA pin

- Confirm if all the details are correct before pressing OK

After repaying your Kashway loan, you will receive a message about your loan payment. If you fail to receive this message and your payment does not reflect in your Kashway account, you can contact Kashway customer care for assistance.

Please note that Kashway does not offer extensions on loan repayments. All loans have a repayment period of 91 – 180 days. So, it’s always good to pay back the app on time to unlock higher loan limits and prevent Kashway from forwarding your details to the credit watchdog, the CRB.

Why Kashway?

So, why bother applying for a mobile loan from Kashway when many lenders are out there? There are even banks with mobile loans, such as Absa’s Timiza and KCB’s MPESA.

Well, that’s because Kashway promises the following advantages:

- You don’t need any collateral to secure a Kashway loan

- Quick loan disbursement to MPESA

- You can slowly grow your loan limit

- The app offers high loan limits (up to Ksh 50,000)

- You can apply for the loan at the convenience of your home

Disadvantages of Kashway Loan App

Though Kashway is a decent mobile lender, it faces a few discouraging factors, which include:

- Loans accumulate high-interest rates (up to 72% APR)

- The app requires a lot of your personal information before lending you

- The customer support agents can be very annoying when they start calling and messaging your contact list when your payment is overdue

Kashway Loan App Contacts

Are you experiencing issues with your Kashway loan app? It could be that you want to inquire a thing or two about the loan app. Well, you can contact them through the following:

- Email address: service@KashWay.cc

- Phone number: +254 0748 449 406

- Official website: kashway.cc

- Physical location: Milestone Building, Kiambu Road

- Facebook: Fb.me/KashwayKenya

Kashway Rewards

Unlike many other online lenders that do not reward their customers, Kashway does. It gives coupons of up to Ksh 800 every time you refer someone to take a loan. So, take the opportunity to refer your friend who needs to take a loan with Kashway.

However, these coupons are valid for 5 – 21 days. So you should be on the lookout and keep updating your Kashway loan app often.

People Also Ask

1. Is Kashway Loan Legit?

Without a doubt, the Kashway loan app is legit. They have a physical office at Milestone Building, Kiambu Road Nairobi, where you can visit them if you have any queries about the loan app.

2. How Much Does Kashway Lend?

The good news is that Kashway is amongst online mobile lenders that give high loan limits. You can borrow from Ksh 500 to Ksh 50,000, depending on your creditworthiness, MPESA dealings, and borrowing history with the lender (if any).

3. Why Did Kashway Decline My Loan Request?

Not everyone can indeed get an instant loan upon application with Kashway. Also, note that it may take several applications to get a loan.

However, if this is the case, it’s advisable not to delete the loan app on your phone and reapply after the stipulated time.

4. How Can I Get a Loan Increase with Kashway?

Remember, Kashway access your phone’s message and contacts before lending to you. So, try out these hacks to get a higher limit:

- Have a good credit score with CRB

- Pay your Kashway loans on time

- Borrow frequently

- Do not delete your MPESA transactions

- Use MPESA services frequently

5. What Happens If I Don’t Pay My Loan?

If you don’t honor your agreement with Kashway, the loan app penalizes you a 2% daily fee of the total loan amount.

And if you are too late in repaying your loan, Kashway forwards your details to the CRB for listing. Please note that you may not get future loans from other lenders, too, once this happens.

6. Can Kashway Grant Permission to Repay My Loan Later?

Unfortunately, once you set a repayment plan, Kashway cannot alter that. You have to keep your word. And if you cannot pay the whole amount at once, Kashway advises that you make partial repayments before the due date.

7. Who Owns Kashway?

Kashway is a product of Wakanda Credit Finance.

8. What Will Happen If I Overpay the Loan?

After a successful reconciliation, you will have to wait for 15 days for the excess amount to be reversed to your MPESA account.

Closing Remarks onKashway Loan App:

Above is all there is to know about the Kashway loan app. If the terms and rates favor you, you can apply for the loan.

Remember, taking a loan is easier than paying. So, I strongly advise that you take up a loan when in dire need. And if you do, ensure that you pay up on time to avoid considerable penalties or CRB blacklisting.