The Kenya Revenue Authority (KRA) is Kenya’s Taxman.

This is the sole agency that was established by an Act of Parliament, Chapter 469 of the laws of Kenya and is mandated to collect revenue on behalf of the government of Kenya.

KRA is headquartered at Times Towers, Haile Selassie Avenue in Nairobi.

You are probably aware that country affairs are run or guided by a budget. The money used to run all government business as envisaged in the budget is collected from the citizens.

That’s how KRA comes in; its services directly affect the country’s development agenda. People pay taxes through this agency and the revenue is in turn used to facilitate government projects.

So, clearly, the importance of KRA is that huge. But, far beyond that, lie other key responsibilities of KRA that, as we proceed, you will definitely come to learn.

With such an enormous duty to perform, you cannot underestimate this government agency.

This article covers the Kenya Revenue Authority in the depths and highs.

KRA Vision

To be a globally trusted revenue agency facilitating tax and customs compliance

KRA Mission Statement

Building trust through facilitation so as to foster compliance with tax and customs legislation

Here are KRA’s Values

- Trustworthy

- Ethical

- Competent

- Helpful

The Core Functions of Kenya Revenue Authority.

The core functions of KRA include the following:

- To assess, collect and account for all revenues in accordance with the written laws and the specified provisions of the written laws.

- To advise on matters relating to the administration of, and collection of revenue under the written laws or the specified provisions of the written laws.

- To perform such other functions in relation to revenue as the Minister may direct.

From the functions stated above, it’s noticeable that the Taxman has for sure improved the country’s taxation revenue – of course since the agency was formed in 1995. This success is a result of organized administration and collection practices.

KRA is committed to fulfilling its mandate through the following roles:

- It helps to administer and enforce all written or specified portions of written laws. This has to do with the assessment, collection, and accounting of all revenues.

- The agency gives advice to the government pertaining to the administration or/and collection of revenue underwritten laws.

- Ensure that tax administration is effective and efficient.

- Eliminate tax evasion through the creation of simple procedures and improving taxpayer service and education. This helps to increase compliance among taxpayers.

- Promoting professionalism and eliminate corruption amongst the employees of KRA. Paying the employees adequate salaries attracts the right group of professionals and inculcates the ethics and integrity as required by law.

- Eradicate the potential budget pitfalls and deficits by creating the organizational structures that maximize the collection of revenue. This is key in helping restore the economic independence and sovereignty of the State.

- Ensure that the local industries are well protected to facilitate their growth economically by effecting fair trade laws.

- Effective allocation of scarce resources in the economy.

- Ensure that the distribution of income is done in socially-acceptable ways

- Facilitate economic stability and moderate cyclic fluctuations.

- KRA is a watchdog for other government of Kenya agencies and departments such as the Ministries of Health, Finance, etc.

Kenya Revenue Authority Departments.

It is no easy feat managing the national revenue. It is a complex task that needs some solid organization structure within the KRA.

Which is why the agency works in five different departments. Besides the Commissioner General, each KRA’s department is run and managed by an Official Commissioner and the department is also mandated with a specific aspect of national revenue.

Let’s have a look at the five KRA departments:

1. Customs Services Department

The Customs Services Department comes as the largest department in KRA. Customs is the one with the most staffing.

The main responsibility of this department is to collect and manage import duty and value-added taxes (VAT) on imports. But sugar levies, petroleum development levies, road transit tolls, and air passenger service charges are also a part of its mandate.

The department must ensure that no illegal goods are smuggled across the border into the country. On top of that, it also manages the revenue collected by other departments.

2. Domestic Taxes Department

This department consists of two divisions: the income tax and the value-added tax (VAT). That is to say, generally, collecting and accounting for taxes generated locally.

The Domestic Taxes collects both resident and non-resident individual taxes which include PAYE remittances paid by the employees through their employers. Then, there’s the withholding tax which is paid by any person who receives dividends, professional fees, etc.

Other taxes collected include VAT and Advance Tax (tax paid by persons in possession of public service and commercial vehicles).

3. Road Transport Department

Kenya Revenue Authority road transport department is keen on all licensing and registration requirements for drivers and vehicles. It collects taxes related to transport on roads.

Also, it enforces the law to ensure that drivers and vehicles adhere to the regulations.

The same department is in charge of the fees, levies, taxes, and duties which are involved with the importation of vehicles into Kenya.

4. Support Services Department

The Support Department handles internal matters of KRA. It manages the day to day work for KRA.

Matters human resources, legal services, corporate planning, and public relations are all under this department.

5. Investigations and Enforcement

This is the department that’s responsible for carrying out investigations in case of problems such as fraud and tax evasions, illegal import documentation and improperly registered vehicles.

In a nutshell, the investigations department handles all tax and customs investigations.

KRA operates in five regions in the country including Central, Western, Rift Valley, Southern and Northern Regions. This way, it can manage its countrywide operations with convenience.

Kenya Revenue Authority: KRA Pin Registration and Pin Checker.

What is a KRA PIN?

A KRA pin is a personal identification number that gives one an identity that is crucial for transacting business with the KRA, the Government of Kenya and other service providers including private employers.

You don’t want to miss a PIN if you are 18 years and over. It is a massive number for any serious patriotic citizen.

So just why is it such an important number?

The Importance of a KRA PIN

A PIN is needed in the following situations: –

- When a student needs to apply for a HELB loan

- A company needs to open a bank account

- An employer wants requires a PIN before employing you

- Registration of a title deed and payment of land rent

- Application for a business permit, payment of water deposits

- Registration of business names and companies

- Application for value added tax registration

- Importation of goods; customs clearing and forwarding

The list goes on and on.

How to Register for a KRA PIN as an Individual

KRA PIN registration process isn’t rocket science or something else. Here are quick steps to registration:

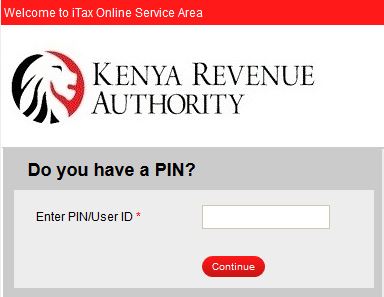

- Visit the iTax website

- Go to the section “New PIN Registration”. You will see a prompt, “Do you want to apply for a PIN, Click here”. Follow that link

- Fill in all the mandatory fields (indicated by a red asterisk)

- After filling, enter the value of the arithmetic operation – it’s usually a simple one.

- Click on submit if everything is okay with you

- Download the e-registration acknowledgment receipt and the PIN certificate. Do this by clicking, “Click here to download acknowledgment receipt”.

How to Register for a KRA PIN as a Company

There is no company in Kenya running its operations without a PIN. With a KRA Pin, the company is able to transact on things like the purchase of land and property, apply for tenders in the government, opening a bank account, filing and making monthly KRA returns and definitely, for the application of a Tax Compliance Certificate.

Whether you want to undertake PIN registration for a company or a partnership, the process is not very much different from what you have seen above for individual PIN.

As a company, you need the following documentation: Copy of certificate of incorporation, Copy of CR12, Copy of Memorandum and Article of Association but this is optional. One of the Director’s Copy of PIN certificate and Copy of Tax Compliance Certificate, and a Copy of Acknowledgement receipt.

Here is the process of PIN application for a company:

- Visit iTax

- Select ‘New PIN Registration’

- Fill the online form appropriately

- Submit an online application

After application, you will receive an acknowledgment receipt. And a follow-up email notification with a PIN or further instructions where you can present the required documentation for verification.

KRA PIN Checker: How to Confirm if Your KRA PIN is Genuine.

The KRA PIN Checker enables one to search and check whether a pin is genuine or not. Genuine PIN is generated by the KRA – Domestic Taxes Department System, stored and it’s in current use.

The information provided by the PIN checker is only limited to PIN numbers and names.

What is the KRA iTax System?

In order to carry about its tax administration and management functions way conveniently, KRA developed a modern-day online system technology called the KRA iTax Kenya. This has not only been a breather for the Taxman, but it has also come to the rescue of many taxpayers.

So what is iTax Kenya?

ITax Kenya is an online-based secure electronic system which comes with a fully-integrated and automated solution for administration of domestic taxes.

The system has been a godsend and thankfully replaced the old KRA online system that had a huge share of challenges.

The iTax system allows the taxpayer to register for a pin, returns filing, payment registration, and status inquiries with real-time monitoring of accounts.

Why Go the iTax Way?

- iTax has come to make tax compliance easy and convenient

- A reduction in time taken to extract data and information on revenue

- Proper time usage for users

- The iTax has improved the ability and accuracy of KRA and taxpayers when accounting for taxes.

KRA Portal: Components of the KRA iTax

- PIN application

- Pin Checker, WHT Certificate checker, TCC Checker

- Generate E-slip

- Electronic filing and amending returns using Excel

- View Taxpayer Account/Ledger

- E-Query

- View Tax Returns filed

- Consult Status of Cases on Compliance, Debt, Audit

- Request for TCC

- Make Application for Refund

- Make Application Transfer of Tax Credits

- Make Application for Payment Plan

- Make Application for Waivers and Write-Offs

Besides the above highlights, there are still several more you will find when you make your iTax login.

The benefits of iTax have been incredible. Before its introduction, taxpayers would queue along with the KRA offices in long lines just waiting to submit their returns.

The process was labor-intensive, marred with corruption and lots of tax evasion. It was not unordinary that many tax malpractices would miss the then Integrated Tax Management System (ITMS).

Things like under-declaration and tax exemption could dominate the tax accounting process.

With that, all said, the coming of the iTax system in 2015 was received with both hands by both KRA and the taxpayers. Today, you can effortlessly submit your tax returns from the comfort of your chair at home or office.

KRA Tax Calculator: How to Calculate Your KRA Tax Deductions.

Every employee has the obligation to pay taxes – pay as you earn (PAYE). PAYE refers to the income tax deductions that KRA makes on your salary, wages, bonuses, commissions, director’s fee or basically any type of income generated.

If a house is provided by your employer, its value is incorporated in the tax deductions. For those engaged in casual employment, there is no PAYE.

Back to the employee. If you have a salary with allowances such as per diem, housing, medical, transport, and school fees allowances, etc., these are added together to get a sum.

This becomes the gross taxable income.

In summary, Gross taxable income = Basic pay + Taxable benefits + Allowances

To get the Net Taxable Income we need to subtract deductions from the Gross Taxable income.

The following three deductions are normally applied to the income of a taxpayer.

1. Retirement Contributions

These are things like the National Security Social Fund (NSSF): This ranges from Ksh.330 to Ksh.1080 per month.

2. Owner-occupied Interest

Mortgage relief is also the other important deduction by KRA that you need to know. Since 2017, KRA has increased this deduction from Ksh.150000 per year to Ksh.300000.

And this is only applied if you are a resident at the property.

What this means is that if you have loans from National Housing Corporation, the Housing Finance or an approved bank, it’s possible that you successfully claim deductions. Just present your proof that the loan you took as a mortgage was truly used to build the house.

3. Home Ownership Savings Plan

The KRA PAYE calculator brings on board all the persons who are making contributions towards owning a home. The contributions are made under a registered home savings plan.

If you are saving, you then qualify for a deduction of up to Ksh.4000 each month. This will go to as far as nine consecutive years on the maximum.

KRA Tax Calculator Tax Relief

There are two types of tax reliefs; personal relief and insurance relief.

1. Personal Relief

The current personal relief as from is Ksh. 2,400 a month which translates to Ksh. 28,800/year.

2. Insurance Relief

As long as you are a Kenyan resident, you are eligible for insurance relief. The insurance covers three key areas: for life, education or health.

The insurance relief deduction is up to Ksh.5,000 per month.

Tax Exemption for Persons with Disability.

It may not be already in the ears of people, but persons with disability receive special treatment from the Kenya Revenue Authority. Which is tax exemption on the monthly and therefore annual income.

If you fall into this category, you are not going to pay any taxes for an income running up to Ksh. 150,000 per month or Ksh.1.8 Million per year.

Which means that any amount you bag higher than the figures highlighted above will, however, be taxed.

As a “person who’s abled differently”, you ought to register your status to the Taxman so that they are aware. The process begins with the application of an Exemption Certificate.

Documents Required When Applying for Tax Exemption Certificate

- Disability Medical assessment report; this needs to show the nature of the disability and is verified by the signature of the Director of Medical Services.

- KRA PIN Certificate

- National ID card

- NCPWD Disability Card

- A certified copy of the latest pay slip where necessary

- A letter from the employer if applicable. It should indicate the nature of the disability and how it affects the employee’s productivity while at work.

- Tax Compliance Certificate

- Applicants need to make a physical appearance before the KRA Domestic Taxes Department officers at the nearest KRA offices for interviews. Then, they will be issued with an acknowledgment slip.

Note that the Tax Exemption Certificate expires after one year and it needs to be renewed. To renew the certificate, ensure that you attach the documents mentioned above plus, a copy of the expired exemption certificate.

To get the exemption certificate, download and fill forms 1 and 2. Log into the iTax to apply and attach the verification documents.

Kenya Revenue Authority: Frequently Asked Questions

1. Can I correct an error once I file returns?

Yes, you definitely can do this by way of filing an amended return.

2. I have a PIN but haven’t traded. Do I still have to submit my tax returns?

Yes. You are required by law to file a nil return. It is simple as logging into your iTax account. Go to the profile, Returns and select the Nil Return option then submit.

3. Can I view a copy of the previous returns that I have filed for the tax periods?

Yes. Do this by going to your account and selecting the returns tab. Choose consult return. And also choose the type of return and the period.

4. Is it possible to change the current email address I am using for iTax? How can I go about this?

it’s very possible to change an email address. Under registration on your profile, the taxpayer is allowed to amend PIN details.

5. I forgot my password

Go to the iTax page. Then select ‘forgotten password’. You will be asked to provide the security question you used when you registered for the first time.

After submitting this information successfully, you will receive an email notification with new login credentials on your registered email.

6. What should I do if my Pin is locked?

Once you report this to the KRA, the blocked password is reset automatically within 24 hours. Although you can send the PIN to KRA to be unlocked through:

Email Callcentre@kra.go.ke and DTDOnlineSupport@kra.go.keOr; Call 020 2390919 and 020 2391099 and 0771628105 Or; Visit the nearest KRA office.

7. What is P9?

This is the summary of the employment income received in a given year. This form is issued by the employer to the employees.

8. Are employee benefits taxable?

Yes. All benefits an employee gets of whatsoever nature as long as it connects with the employment or services rendered will be subject to taxation.

9. Does PAYE include earnings from casual employment?

No. casual employment, however, is defined as employment under one month. But regular part-time employees and regular casual employment are not considered to be casual employees and therefore pay tax.

In Conclusion

Kenya Revenue Authority has shouldered a massive mandate on its back. Having gone through all this information, you want to believe that the agency is one of the busiest and perhaps the most important of all.

Nearly three-quarters of our National Budget is funded by the revenue collected by the KRA. Which means that the agency needs to be efficient and effective in the administration of tax and other revenue obligations.

The best thing that happened to KRA is the incorporation of the iTax system that has come with all the needed convenience both to the KRA and the taxpayer.