If you’re looking for a soft instant loan with no security or guarantors, Tala Loan App is all you need to make your day blissful.

Sometimes back in 2016. My cousin and I went for a function – we had gone to condole with a bereaved family in the neighborhood. To be honest, I was broke and I wouldn’t come out that place without leaving a few coins. It would be a shame!…

After I shared this impasse with my cousin, he remarked, “Have you tried tala mkopo rahisi? Download it now”. ‘What on earth is that?’ I thought, but followed his instructions and downloaded the app.

Once I finished installing, a few questions here and there and I had an active tala loan account. Let me cut short the story: in a matter of an hour, I had Ksh.2000 bob deposited on my Mpesa account!

That easy!?

That’s Tala for you. Unlike a traditional bank – I bet that would be a mission to the moon and back – such is the quickness and convenience of quick mobile loan lending apps. Especially the most established of them all, Tala.

Stay close and I will tell you some interesting things about this mobile lender.

Just as a quick question….

What is Tala for You?

In proper terms, Tala is a mobile lending service that’s a product of Inventure Access. You get a tala loan instantly and that’s to mean in a matter of seconds after successful application.

Tala operates in a number of countries including Kenya, India, Mexico, Tanzania, and the Philippines. Tala is based in California in the United States.

You might have heard of Mkopo Rahisi back in 2013. Actually, that was Tala in its infancy.

Today tala Kenya is a true-to-type mobile lending brand/company. Until April last year 2018, it had disbursed a whopping 5.6 million loans to over 1 million customers in Kenya alone.( In a monetary viewpoint, that is approximately Ksh.28 billion.)

The big question is if that would be possible with the traditional banks. Which makes the words of Steve Murray, a board member at Tala, very sensible:

“We are excited about how Tala is using mobile devices and data-science to unlock this huge unmet opportunity and serve a market that is underserved by traditional financial institutions”.

How Does Tala Work?

Tala loan app starts to work once you’ve downloaded and installed the app on your Android-enabled smartphone.

Then, definitely, you will need to register and apply for a loan. The money will be disbursed in your mpesa account if you are found to be eligible by the lender.

Now, being eligible? Perhaps, this is a big dilemma for you.

How does Tala determine one’s eligibility?

The answer is simple: with your tala loan application submitted, Tala reviews your Mpesa transaction history in detail. In other words, the Mpesa messages are thoroughly scanned.

Depending on the intensity of your transactions, you receive a minimum of Ksh.500 for the start. Although if your accounts are good, this could be a higher figure, say Ksh. 2,000 or more.

You can increase this rate by repaying earlier, completing multiple Mpesa transactions, and using the app more frequently. The highest limit is Ksh.50,000.

Tala Unsecured Loans.

Tala offers unsecured loans: this means that you don’t need to provide a security or guarantor. Security is how faithful a customer will be.

But don’t be fooled that you can take advantage of this situation.

Because the loans are unsecured, the repayment period is very short. For example, at the moment, Tala allows you to choose between a 30-day or 21-day repayment period for a loan.

In addition, the loans come with an interest or service fee as the company calls it. If you are going to repay in 21 days, the service fee is 15% while it’s 11% for 30 days.

Related Post: Best Loan Apps in Kenya For Quick Mobile Loans

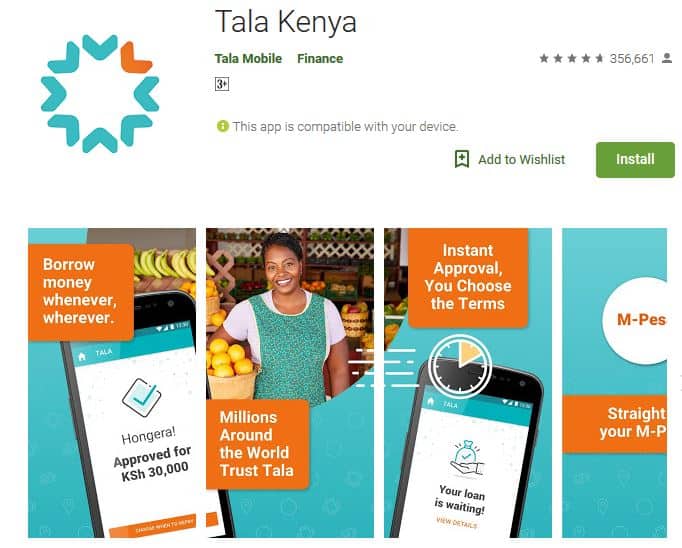

Tala App Download for Android.

To get the Tala app download, you need an Android-enabled smartphone or any other internet-enabled device like a tablet.

When using a phone, you will have to download the app from the Google Play Store. Here is the process in a flash:

- Go to Google Play Store on your Android device

- Search for the Tala app and click install

- It will download after which you need to install on your android

- Register your account: here an active Mpesa line is a must.

- You will be required to provide other personal details as well – things such as full names, current employer if you’re in employment, a national ID number, etc.

Here is the process to follow if you’re downloading the app for Microsoft:

- Go to the Microsoft store on your tablet or computer

- Search for Tala app for Microsoft

- Click ‘Get’ to install the app on the computer

- Register your details

- Start enjoying the app

If you are an iPhone user, getting a loan from Tala is impossible. Tala needs access to all messages on your phone – this is against the policy of Apple (the maker of iPhone and other iOS devices).

Apple values the security of its users, making it’s operating systems the most secure.

Here is the Process of Applying for a Tala Loan.

Instant mobile loans in Kenya have brought some calm in the lives of many Kenyans especially in times of emergencies. You can afford a smile once you know (oh!) Tala’s right on my back in this tricky situation.

Well. The process of applying for a loan is as easy as you can see right next:

- Find your Tala app and log into your Tala account

- Once you are logged into the app, it scans your phone messages in an instant.

- Go to the ‘apply now’ button and click. You will be directed to a few questions: some of them may include things like the reason for taking a loan, if you have outstanding loan balances, etc.

- After submitting answers to these questions, the amount you qualify for will be displayed on the screen.

- Select a repayment schedule; you have 21-day and 30-day repayment periods to select from. The shorter the period, the less interest you are going to pay.

- You will then click ‘Send My Loan’ and within seconds, money is sent to your phone. Note that the amount doesn’t include withdrawal fees – this is purely on you.

That’s for the person who’s in good books with the lenders. In case you find your application turned down, your records are bad with either the tala loan app or other lending institutions.

You probably have the following:

- Outstanding Tala loans if you are an existing user. You can’t borrow another one before clearing your arrears.

- You were late in repaying the previous loan

- Outstanding loans with other financial services

- Defaulted a previous loan either with Tala or other service providers and you got listed on the CRB – CRB records all defaulters and is a reference for lending service to determine the creditworthiness of a borrower.

- Mpesa transaction history is unsatisfactory

Repaying Your Tala Loan.

Now onto the bitter part. Really sorry for saying that but… it’s the truth. When borrowing, and especially if you are successful (it’s a yay!).

Oftentimes, repayment is a thorn in an elephant’s toe.

Just joking anyway. Here is the process on how to repay tala loan:

- On the Mpesa menu, select Lipa na Mpesa option

- Choose pay bill

- Enter Tala’s pay bill number 851900 as the business number

- Enter the Mpesa number you registered with Tala as the Account number

- Check to ensure that the details, both pay bill and account number are correct. If sure, submit to send the payment.

- Mpesa will send you a confirmation message for the transaction. Tala/Inventure will also send you a payment confirmation message.

- Your records will be updated and the same reflected on your Tala App.

- You could choose to apply for another loan or take a sabbatical – after all, it was just an emergency and it’s all gone.

How to Contact Tala.

The first point of contact is the app you have on your device. But other than that, make use of the following communication channels:

Email: hellokenya@talamobile.com

Facebook: @TalaKenya

Twitter: @TalaKenya

Tala Loan App: FAQs

-

How long does Tala take to approve a loan?

It takes not more than 10 minutes. Most of the times it only goes up to a minute and the money is disbursed into your account.

At the same time, if you don’t qualify for a loan, you will be notified promptly.

-

Can I top up a loan while I still have a pending one?

No. you don’t take up another loan before you finish the current, pending one. Once you complete, feel free to take another loan.

-

How do you use the answers I give when applying for a loan?

They are part of eligibility criteria for a Tala loan. You should know that we keep all information private and confidential.

Also Read: how to get clearance from crb kenya

In Conclusion

I am hopeful that you’ve been helped with this information.

Tala is the perfect app that you need to get out of financial hurdles that require urgent attention. With no security or guarantor information required, getting a quick soft loan in an instant is quite a breather.

All you’ve got do is to download the Tala loan app, ensure that you register and other things will follow.