Did you know that 35% of smartphone owners borrow money using their phones? Well, a study focusing on the best loan apps in Kenya reveals that.

Interestingly, 35% of these Kenyans borrow to meet their household needs while 37% borrow for business reasons. Despite the hefty interests that these loan apps charge, the reality is that some Kenyans cannot resist the temptation.

So, are you in the same position as those Kenyans who want instant cash but have no one to turn to other than mobile lenders? Then it’s important that you get the fairest of deals and that’s what I’ll focus on in this article.

I’ll help you compare the best mobile lenders so that you can settle on the best. As at June 2019, the number of these apps hit 49 and counting. I’ll however focus on the best 25.

In a rush? Check out a summary of these top 25 mobile loan apps on the table below!

Table Summary: 25 Best Mobile Loan Apps in Kenya

| Loan | Limit | Interest Rate | Payment Period |

| Branch | Ksh 250 – Ksh 100,000 | 17-35% of the loan amount | 4-52 weeks |

| Tala | Ksh 2,000 – Ksh 30,000 | 11-15% of the loan amount | 21-30 days |

| KCB MPESA | Ksh 1,000 minimum | 8.64% of the loan amount | 30 days |

| Stawika | Ksh 200 – Ksh 30,000 | 15% the loan amount | 30 days |

| Timiza | Ksh 50 – Ksh 150,000 | 1.17% the loan amount | 30 days |

| Mshwari | Ksh 100 – Ksh 50,000 | 7.5-9% the loan amount | 30 days |

| Zenka | Ksh 500 – Ksh 30,000 | 70.7-224.89% APR | 61 days |

| Utunzi | Ksh 500 Ksh 50,000 | 12% of the loan amount | 21 days |

| Haraka | Ksh 500 – Ksh 5,000 | 23.45% | 7-31 days |

| Zidisha | Up to Ksh 1 million | 0% interest (only Ksh 1000 membership fee) | Unspecified |

| iPesa | Ksh 500 – Ksh 5,000 | 12% APR | 91-180 days |

| Opesa | Ksh 1,500 – Ksh 50,000 | 16% maximum APR | 91-365 days |

| Saida | Ksh 600 – Ksh 100,000 | 0-21% monthly | 2.5-6 months |

| Okash | Ksh 500 – Ksh 50,000 | 36% maximum APR | 91-365 days |

| Okolea | Ksh 500 – Ksh 500,000 | 0.5% Daily | 2-28 days |

| Eazy | Ksh 100 – Ksh 200,000 | 2-10% of the loan amount | 30 days |

| Berry | Ksh 1,000 – Ksh 50,000 | 9.25% monthly | 65-120 days |

| Mokash | Ksh 2,000 – Ksh 10,000 | 20% the loan amount | 14 days |

| Credit Hela | Ksh 1,500 – Ksh 80,000 | 36% maximum APR | 91-365 days |

| Zash | Ksh 500 – Ksh 50,000 | 25% maximum APR | 91-365 days |

| Kashway | Ksh 3,000 – Ksh 50,000 | 5-16% APR | 100-270 days |

| Lion Cash | Ksh 2,000 – Ksh 70,000 | 16% APR | 91-365 days |

| KashPlus | Ksh 2,000 – Ksh 50,000 | 16% APR | 91-365 days |

| AsapKash | Ksh 500 – Ksh 8,000 | 18% APR | 91-365 days |

| Apesa | Ksh 500 – Ksh 8,000 | 18% APR | 91-365 days |

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

25 Amazingly Best Loan Apps in Kenya.

1. Branch Loans App

Although Branch loan app came after the emergence of many others, it seems to be one of the unprecedented leaders in the mobile micro-lending industry at the moment.

Branch loan app offers you a loan within the range of Ksh 250 – Ksh 100,000 and charges you an interest of 17-35% of the loan amount. You, however, have 4-52 weeks to pay up; all depending on the amount you borrow.

Requirements

You should meet these requirements to apply for a Branch loan:

- Registered MPESA number

- Facebook account

- Kenyan ID

- Android smartphone

- Good credit rating

Download

Branch loans app is simple to install from Google Play Store. It occupies only about 4 megabytes of your Android space meaning its easy and cheap to download.

Once you have the app on your smartphone, creating an account is a breeze. Ensure that you have an active Facebook account that you’ll be required to log in and the rest is easy.

Registration and Loan Application

Here’s how to sign up for Branch and apply for your first loan:

- Download Branch from Google Play and install it on your phone

- Launch the app and sign up for an account

- Log into your app and go to the ‘Loan Option’ on your homescreen

- Fill out your personal details and MPESA number

- Select loans and thereafter tap Apply

Remember, all payments involving Branch are through the paybill number 998608.

2. Tala Loan App

The next household name in the Kenya Quick loans sector is Tala. By the way, Tala is one of the oldest loan apps in Kenya having been on this scene for now about 6 years.

It operates under Inventure Access company that offers quick mobile loans in Kenya. Tala was formerly known as Mkopo Rahisi before it switched names.

Tala uses your transaction history as reflected by the Mpesa to determine your creditworthiness. This is used to decide which amount will be offered to you or in other cases, no offers.

The minimum amount you can receive from them is Ksh 2,000, the maximum is Ksh 30,000.

The app offers two options when it comes to repayment; a 30-day repayment period or a 21-day repayment. If you choose to go with the former, the service fee is obviously higher than a loan repaid within 21 days.

Tala loan interests range is 11-15%. This largely depends on the repayment period option one chooses to go with.

Requirements

You should meet these qualifications to apply for a loan from Tala:

- Be 18 years or older

- Have a registered MPESA number (active for at least 6 months)

- Own a Kenyan ID

- Have an Android smartphone

- Have a good credit score

Note that all Tala payments are through the paybill number 851900 and that Tala charges a 4-14% service fee for its loans. Moreover, you may pay 8% penalty for late payments. The payment is howevr one-off.

Registration and Loan Application

Follow these steps to procure a loan from Tala:

- Download Tala from Google Play and install it on your Android phone

- Launch the app and pick your preferred language

- Create an account or sign in if you had created it before

- Go to loan application and tap on ‘Apply Now’ and follow the ensuing steps

3. KCB Mpesa Loan App

This is another one of its kind. KCB Mpesa loan came into being as a result of a partnership between Kenya Commercial Bank and Safaricom.

The loan is available to only Safaricom customers. KCB Mpesa loan is arguably the cheapest when it comes to interest rates application, on this list. The app charges an 8.64% interest for its loans which start from Ksh 1,000 and are payable within 30 days.

Besides accessing this loan through Safaricom on Mpesa, one can download a KCB mobile banking app, create an account and be able to start enjoying its affordable loan offers.

If approved for a loan, it will be disbursed immediately into your KCB mpesa account. What it means for you is that you’ll have to transfer this money into your Mpesa for withdrawal for free.

One of the most interesting features about this app is the flexibility of repayment and the affordable interest rates. For example, you can choose to repay your KCB mpesa loan in one month, two months or three – absolutely depending on your capability.

Requirements

- Be a registered MPESA customer

- Kenyan Id

- Smartphone

- Good credit rating

Application

Follow these steps to apply for a KCB MPESA loan:

- Go to the MPESA menu on your phone and and select loans & savings

- Go to KCB MPESA

- Select loans and then click on Request Loan

- Enter the amount you want to borrow and then your MPESA pin

- Tap on submit

Also Read: KCB Vooma Loan

4. Stawika Loan App

Stawika is also another app that offers loans in Kenya without security. Coming as a product by the Stawika Capital Limited, a Kenyan-based company, Stawika is one of the apps an ordinary Kenyan will trust.

With the app on your phone, registration of your account is very straightforward with no attached first-time fees.

As it is with other mobile lenders, Stawika also assesses one’s mobile phone data to assign loans. And you won’t have to wait for long as the process is within less than 5 minutes.

Once you are approved, the money is wired straight into your Mpesa account.

If this loan is repaid on time, Stawika increases its loan limits quite fast.

The minimum one can get from this mobile lender is Ksh.200 and the maximum can go up to Ksh.30000 at a 15% interest.

However, you are required to repay the loan within one month. Of which you don’t, a rollover fee of 10 percent will be applied on the principal amount and have your repayment time extended.

Requirements

They include:

- Be at least 18 years

- Good credit rating

- Registered MPESA number

- Android smartphone

Registration and Loan Application

Here are the steps to take:

- Download Stawika and install it on your phone

- Register for an account by following the sign up steps

- Wait for Stawika to display your loan limit

- Tap apply

5. Timiza Loan App

Among the recently launched best loan apps in Kenya, Timiza loans are just simply admirable and worth making a try.

The Timiza loan app is a product of the Barclays Bank of Kenya. Having seen how fast things were changing in the financial sector (more so the potential in digital borrowing), Barclays blew this market space with Timiza loans for both their account and non-account holders.

Actually, the app is the best in its own rights: it comes with extremely flexible loan offers and repayment periods. While the interest rates are something that seasoned borrowers would wet their mouths for.

That said, account registration is free and simple; also coming with the option of registering it using the Timiza account registration USSD code *844#.

When the loan request is approved one receives it within a few minutes. Usually, the amount is deposited into your Timiza wallet from where you will transfer into the Mpesa account for quick withdrawal.

The minimum loan amount one can borrow depends on their creditworthiness after the app scans the Mpesa transactions. So numerically, the lowest you can borrow is Ksh.50 and Ksh.150,000 as the highest limit.

The Timiza interest rates are very low, at 1.17 percent while a one-time facility fee of 5% applies on all loans.

Requirements

- Be a registered Safaricom customer

- Have an active MPESA line (at least 6 months active)

- Good credt rating

- Kenyan ID

Registration and Loan Application

- Download Timiza from Google Play and install it on your phone

- Sign up for an account using your MPESA number and create a unique 4-digid password

- Log in to your account and access My Loans

- Apply for the loan and wait for the amount to to be disbursed to your Timiza account

6. Mshwari

Someone may want to ask why the heck Mshwari is appearing sixth on the list. There is no big issue. Mshwari is a product of Safaricom.

I have stashed it right here as there it has no traditional apps we are used to. So, no personal beef. In fact, Mshwari is the most popular mobile lender currently in Kenya.

And for that matter, it offers instant mobile loans in Kenya. It should be the first one to have entered the unsecured mobile loan lending scene before others joined the park.

Requirements

To apply for this loan, you just need to have an active Safaricom and Mpesa account that has been running for the last six months. You also need to be saving with Mshwari and be a regular user of Mshwari and MPESA services.

Registration and Loan Application

To register:

- Go to MPESA on your phone and access loans & savinings

- Select Mshwari and opt for account activation

- Wait for a confirmation SMS indicating your Mshwari account is active

- Save up with Mshwari for a few months before trying to apply for a loan

To apply for a loan;

- Go to MPESA and opt for loans and savings

- Select Mshwari and go to Loan

- Click on Request Loan

- Enter the amount you want to borrow (according to the limit you received via SMS during the account registration)

- Enter your MPESA pin

- Confirm the information and press Okay

Overall, you can borrow anything between Ksh.100 to Ksh.50,000. While the interest rates on this loan are very low; a one-time facility fee of 7.5 percent.

Repayment is done in one month. Failure to pay on time attracts an additional 7.5% penalty but you’ll have up to 30 dextension period)

Remember, Mshwari also features other services such as lock savings account where you can save money for a defined period of time.

7. Zenka Loan App

On this scene enteres Zenka loan app, the new boy in town. With Zenka, you can borrow Ksh 500 – Ksh.30,000, attracting a 707-224.89% annual percentage rate (APR).

It’s highly rated on the internet as can be seen from the many positive feedbacks from the users. Currently, Zenka is giving an offer to its first-time customers – that’s a free first loan if you are new to Zenka.

Zenka offers flexible repayment options, allowing you up to 61 days but you can pay up in two installments.

The interesting aspect of Zenka is that they can give you a loan regardless of the banking history you have. The Zenka app is also easy to download and use – simple user interface.

Requirements

They include:

- Registered safaricom and MPESA line (active for at least 6 months)

- Androi smartphone

- Kenyan ID

Registration and Loan Application

Here’s how to go about it:

- Download Zenka from Google Play and install it

- Sign up for an accountusing your name and phone number

- Accept the terms and wait for the confirmation message

- Sign in to the app and access loans

- Enter the loan amount and the term of payment

- Click on Get Loan and wait for a verification message

8. Utunzi Loan App

Utunzi Loan App is the next among the best loan apps in Kenya. A dedicated mobile loan app that disburses instant money into your mpesa account.

Utunzi allows you to borrow Ksh 500 – Ksh 500,000 and sometimes up to Ksh 1 million in case of a business. The company allows you to pay back the loan within 21 days for short-term options and up to 91 days – 36 months for long-term loans.

Their loans attract a service fee of 12 percent and an APR of 12 percent but you must pay Ksh 400 account management fee annually.

Requirement

You will need to fill a questionnaire when signing up for the app.

Registration and Loan Application

Follow these steps:

- Download Utunzi loan app and install it on your phone

- Sign up with your personal details

- Log into the app and select apply for a lion

- Enter the amount you wish to apply

- Answer the questionnaire

- Attach your I.D and add referrees

- Submit your application

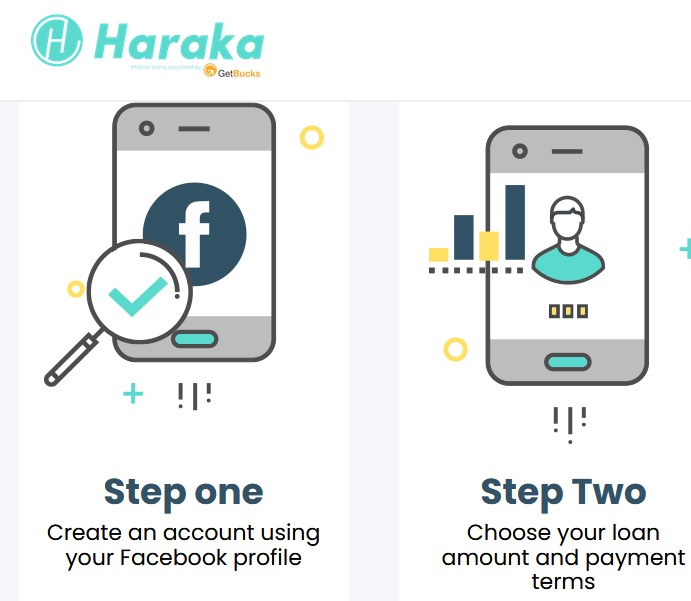

9. Haraka Loan App

With Haraka Loan App, one is guaranteed loan amounts between Ksh.500 – Ksh.5,000. While this limit can increase with time as one clears their debts in time.

Haraka charges 23.45% interest and you have 7-31 days to pay the loan back.

Requirements

Haraka expects you to meet these requirements:

- Be a registered MPESA user

- Have a Kenyan national ID

- Possess an Android smartphone

- Have a clean CRB record

Registration and Application

Registering an account with Haraka doesn’t need lots of personal details from you. Just register with your Facebook account to create a Haraka account.

Credit performance will inform Haraka how much to allocate you. After you’ve been provided with your limit, you can apply for the loan and specify the period of repayment.

10. Zidisha Loan App

Zidisha interacts directly with the entrepreneurs who borrow from them. So, it’s not just one of the money lending apps in Kenya, it also serves as a platform that gives an opportunity for the lender to engage the borrower regarding the progress of the projects for which loans were disbursed.

Zidisha is also known to be a committed promise keeper. It wants to ensure that all customers are satisfied and if not, 100% of the lender credit uploads, donations and services fees paid by that member are refunded.

Unlike the traditional version of the lending apps, Zidisha uses the peer-to-peer lending model. This means that there are independent lenders giving their money for credit rather than an organization.

Requirements

You need to meet these requirements to borrow from Zidisha:

- Have access to the internet

- Have an income source that enables you to make weekly payments

- Rcommendation from a reliable community leader

Application

You need to fill in an application form and pay a premium membership fee of Ksh 1,000 (one-off fee) once your loan request goes through.

Note that a service fee of 5% applies on Zidisha loans and a credit risk payment (ranging from 5-30 percent). There are however no interests.

Overall, one can borrow up to Ksh.1M.

More Loan Apps in Kenya

Here are more loan apps in Kenya:

11. iPesa Loan App

The iPesa Loan App is one of the fastest-growing loan apps in Kenya, which promise anything between Ksh 500 and Ksh 50,000.

This Chinese-owned loan app offers you up to 91-180 days to pay back the loan, attracting an annual percentage rate (APR) of 12%. However, the commonest tenure is 14 days, which attracts a 2% daily penalty.

Requirements

Here are the general requirements for iPesa loan eligibility:

- A registered M-PESA line (one that has been active for at least six months)

- Internet-enabled smartphone

- Be 18 years or older

- Kenyan ID

Download

You can download iPesa on Google Play or App Store.

Once you download the app and install it on your phone, you should go ahead and register for an account.

Account Registration and Loan Application

Follow these steps to register for an account with iPesa and apply for your first loan:

- Launch iPesa on your phone

- Click ‘New Registration’

- Give iPesa access to your phone contacts, SMS, and other information

- Wait for a confirmation message to enable you to set your password

- Apply for the loan that you qualify for and wait for the cash on your phone

Note that all iPesa payments are through the pay bill number 192010.

12. Opesa Loan App

Serviced by financial giant Tensport Kenya Limited, the Opesa Loan App enjoys more than a million installations.

This loan app allows you to apply for anything between Ksh 1,500 and Ksh 50,000, depending on what you qualify for. Of course, the limit hugely depends on your credit score.

Requirements

Here are the general requirements for eligibility:

- Be 18-55 years

- Own a Kenyan ID

- Own an MPESA line that has been active for at least six months

- Have a good credit score

- Possess an Android smartphone

- Access to the internet

With Opesa, you’ve 91-365 days to fully pay back the loan, which attracts an annual percentage rate of up to 36%. And when you default to pay, the loan attracts a 2.4% daily penalty, and you’ve to pay a service fee of Ksh 100- Ksh 600.

All Opesa payments are through the pay bill number 606280.

Registration and Loan Application

Here are the general steps for registering and applying for an Opesa loan:

- Download Opesa from Google Play and install it on your phone

- Launch the app and then fill out the application form with relevant contact and work information

- Once you complete the signup, agree to the app’s terms and conditions

- Set a pin and wait to see how much you qualify

- Apply for the loan and wait to receive the money on your phone

13. Saida Loan App in Kenya

Unlike most loan apps in Kenya , Saida allows you to apply for a loan even using your Airtel line. So, it’s not just MPESA.

This loan app, which also doubles up as a payment app, allows you to borrow Ksh 600-Ksh 100,000, depending on eligibility.

Requirements

- Android smartphone

- Registered MPESA or Airtel number

- Kenyan ID

- Allow Saida access to your phone

- Good credit score

- Steady income

Depending on how much you borrow, Saida charges you a monthly service fee of 0-21%, and you need to pay the loan in 2.5-6 months.

Registration and Application

Follow these steps:

- Download the Saida app from Google Play and install it

- Create a user account and fill out the application form with relevant personal details

- Select the loan that you qualify for and your flexible repayment period

- Accept the terms and wait to receive the money

Note that Saida charges a 10% penalty for late payments. All payments are, however, through the pay bill number 854400.

14. Okash Loan App in Kenya

Offered by Investment giant OneSpot Technology, Okash is one of the oldest mobile lenders in Kenya. The company is now available in Nigeria, showing its popularity on the African continent.

The app allows you to borrow Ksh 500-Ksh 50,000, payable within 91-365 days, depending on the amount.

Requirements

Here are the general eligibility requirements:

- Be 18-55 years

- Have a registered MPESA line

- Possess an Android phone

- Have a good credit record

- Possess a Kenyan national ID

- Have a steady income

- Give Okash permission to access your personal phone information

Overall, Okash attracts a maximum APR of 36%, and you get to pay a one-time service charge of Ksh 100-Ksh 3,000, depending on the loan size. Okash also charges a 2% penalty for payment overdue, and all payments are through the pay bill number 612224.

Registration and Application

Here’s how to get started:

- Download and install Okash on your phone

- Launch it and click on ‘sign up.’

- Fill out the signup form to activate the account

- Once the account is active, apply for a loan you are eligible for and its repayment tenure

- Accept the terms

15. Okolea Loan App

Okolea is a product by Okolea International that dates to 2017. Though this app doesn’t enjoy the popularity it once used to, it’s one of the few applications that can loan you up to Ksh 500,000.

However, their lowest limit is Ksh 500, which most first-time applicants get.

Even the rates are pretty decent, given that you incur a 0.5% daily interest. So, the quicker you pay back the loan, the more comfortable the rates are.

The best part is that you can borrow more than once, provided you stay within your limit.

Requirements

You must meet these minimum requirements to be eligible for an Okolea loan:

- Be at least 18 years

- Have a registered MPESA line

- Possess an Android phone

- National ID

Overall, there is no minimum loan repayment period, but the maximum is one year, attracting 0.8-180%, depending on the repayment tenure and how much you borrow.

However, most first-time loans come with a 2-28 repayment duration

Registration and Application

Here’s how to sign up and apply for your first Okolea loan:

- Download Okolea from App Store or Google Play and install it.

- Fill out the application form to register

- Give Okolea access to your phone

- See how much you qualify for and apply

Generally, all Okolea payments are through pay bill number 245316.

16. Eazy Loan App in Kenya

Eazy Loan is a product by Equity Bank that offers eligible equity account holders up to Ksh 200,000 on their mobile phones. The minimum amount, however, is Ksh 100.

You have up to 30 days to pay back, and the loans attract a 2-10% interest rate.

Requirements

You must meet these conditions to apply:

- Be an active Equity account holder (at least by six months)

- Have an Easy app or active Equitel line

- Have a good credit score

So, generally, Equity allows you to borrow an Eazy Loan either through the app or an Equitel line.

Registration and Application

Here’s how to go about it the app way:

- Download the Eazy app from Google Play and install it

- Sign up with personal details before logging into the app

- Select loan

- Look for the Plus (+) sign and click on it to opt for ‘request loan.’

- Pick the equity bank account that the money should be deposited

- Enter the amount you wish to borrow

- Select Request Loan

- Confirm the details and accept the terms

17. Berry Loan App in Kenya

A product of Finberry Capital Limited, the Berry Loan App dates to 2018. Few apps can match the offer with the Berry promising Ksh 1,000 – Ksh 50,000.

Berry charges you a monthly interest of 9-25% depending on the loan amount, and you have 65-121 days to repay it. However, failure to pay the loan attracts a `10% penalty on top of what you owe.

But before slapping you with the penalty, Berry offers you a 7-day grace period once your payment is due. So, it’s only after seven days that the penalty comes into effect.

All Berry payments are through the pay bill number 977888.

Download and Requirements

You can download Berry from Google Play, and here are the minimum requirements:

- Be 18 years or older

- Own an MPESA line that has been active for six months at least

- Possess an Android smartphone

- Have a good credit score

- Have a Kenyan Id or valid passport

Registration and Loan Application

Here are the general steps for registering for a Berry account and applying for the loan:

- Download Berry from Google Play and install it on your phone

- Launch the app and sign up using your MPESA line

- Wait to receive an OTTP code via SMS, which you should enter to set your pin

- Log into your account to see how much you qualify for

- Select the loan and accept the terms

- Wait for about 2 minutes to receive the loan

18. Mokash Loan App in Kenya

Served by Mocash, Mokash is one new entrant into the Kenyan mobile lending sector. But despite it being a newbie, Mokash enjoys an impressive rating on Google Play and a considerable number of downloads.

Mokash offers you anything between Ksh 2,000 and Ksh 10,000, depending on what you qualify for, and you have 91-365 days to pay back.

Overall, the loans attract a maximum APR of 36% with zero service fee.

Requirements

Here are the requirements for downloading Mokash:

- Be 20 years or older

- Have a Kenyan ID

- Have an active MPESA line (at least six months active)

- Give Mokash access to your phone

- Have an Android phone

Note that Mokash charges a 2% daily penalty for repayment delays. It’s also worth noting that Mokash has short-term loans payable within 14 days, attracting a 20% interest.

All of Mokash’s payments are through pay bill number 4023691.

Registration and Application

Here’s how to register and apply for a Mokash loan:

- Download Mokash from Google Play and install it on your phone

- Launch it and sign up with personal details

- Pick a loan that you qualify for and apply

- Wait for the loan disbursement

19. Credit Hela

Very few loan apps in Kenya can loan you up to Ksh 80,000. Well, Credit Hela promises to offer you anything between Ksh 1,500 and Ksh 80,000, depending on eligibility.

According to the app, its loans are repayable within 91-365 days, attracting a maximum APR of 36%.

Requirements

To sign up, you need to meet these minimum requirements:

- Own an Android smartphone

- Be 18 years or older

- Have an active bank account

- Have an active MPESA line (at least six months active)

- National ID

- Give Credit Hela access to your phone contacts and SMS

Unlike most loan apps in Kenya, Credit Hela charges you a one-time processing fee of Ksh 100-Ksh 600. And when you are late with payments, Credit Hela charges you a 2% daily penalty.

All Credit Hela payments are through the pay bill number 7186653.

Registration and Application

Here are the steps for registering and applying for a Credit Hela loan:

- Download Credit Hela from Google Play

- Fill out the application form to sign up for an account

- Wait for approval from Credit Hela

- Apply for the loan that you qualify for and wait for the money on your phone

20. Zash Loan App in Kenya

Zash is another instant loan provider that you can count on during financial emergencies. It’s owned by Kopa Cash Limited and enjoys more than 500K downloads.

Depending on eligibility, this mobile loan app offers you anything between Ksh 500 and Ksh 50,000.

Zash loans attract a maximum APR of 25%, which is pretty decent compared to other apps. Overall, you have up to 91-365 days to pay back.

According to Zash, you don’t need any credit report, and you can even apply for a repayment extension, things you don’t get from other apps.

Requirements

You need to meet these requirements to apply for a Zash loan:

- Have a Kenyan ID

- Be 18-60 years

- Have an income source

- Own an Android smartphone

- Have a registered MPESA line that has been active for at least six months

Registration and Application

Here are the steps to follow:

- Download Zash from Google Play and install it on your phone

- Launch it and then sign up for an account

- Fill in personal details and accept the loan’s terms and conditions

- Wait to see how much you qualify for and apply

Note that Zash charges a 2% daily penalty for overdue loans. Plus, all Zash loan payments are through pay bill number 733555.

Also Read:

- Best Loan Apps Without CRB Check

- Loan Apps in Kenya Without Registration Fee

- How to Increase Fuliza Limit Fast

Other Loan Apps in Kenya

Here are five other loan apps in Kenya:

21. Kashway Loan App

Kashway, a product by credit giant Wakanda Credit Ltd, promises instant loans with no paperwork to those eligible. This app allows you to borrow Ksh 3,000 to Ksh 50,000, depending on your eligibility.

Requirements

Here are the general requirements for loan application:

- Own an Android smartphone

- Be at least 18 years

- Have an active MPESA account (active for at least six months)

In terms of interests and fees, Zash offers you up to 100-270 days to pay back, and the loans attract an APR of 5-16%. Additionally, the lender charges a one-time processing fee of Ksh 100 – Ksh 2,000 and a 2% penalty per day.

Registration and Application

Here’s how to apply for a Kashway loan:

- Download Kashway on Google Play and install the app on your phone

- Use your MPESA number to register for an account

- Apply for the loan that you qualify for

- Wait for the approval, and you’ll receive money on your phone in minutes

Note that all Kashway loan payments are through pay bill number 900068.

22. Lion Cash

Owned by Grola Tech Limited, Lion Cash is another loan app that promises flexible repayment terms and fees. With Lion Cash, you can borrow Ksh 2,000- Ksh 70,000, and you have up to 91-365 days to pay.

Lion Cash charges zero service fee, but the loan attracts a 16% APR.

Requirements

Here are the requirements for applying for a Lion Cash loan:

- Be 20-60 years

- Have a Kenyan Id

- Have an Android smartphone

- Possess a registered MPESA line

Once you meet the application requirements, you can go ahead and register for an account

Registration and Application

Here are the general steps to follow:

- Download Lion Cash from Google Play and install it on your Android device

- Sign up for a user account using your MPESA line

- Secure your identity on the app and wait to receive a unique code

- Use the code to confirm your identity before applying for the loan that you qualify

- Wait to receive money on your smartphone

Note that Lion Cash offers referral bonuses and occasional rewards to its customers. Moreover, payments are through the pay bill number 309517.

23. KashPlus Loan App

If you are looking for loan apps in Kenya with zero service fees and a low-interest rate, KashPlus is worth consideration. This app charges you a 1-3% monthly interest or up to 16% annually, and you can borrow Ksh 2,000- Ksh 50,000.

All its loans are payable within 91-365 days through their pay bill number 4050763.

Requirements:

The eligibility requirements include:

- Kenyan citizenship

- Be 20-60 years

- Android smartphone

- Active registered MPESA number

Registration and Application

Here’s how to register and apply for your first KashPlus loan:

- Download KashPlus from Google Play and then install it

- Launch the app and then register for an account

- Log into your account to see how much you qualify for

- Apply for the loan and accept the terms

Though KashPlus doesn’t specify the penalty for late payments, all payments are through the pay bill number 4050763. Plus, they charge a 5-33% service fee.

24. AsapKash Loan App

Owned by Joyot Technology Ltd, AsapKash allows you to borrow up to Ksh 8,000, with the minimum amount being Ksh 500.

Requirements

Here are the general eligibility requirements:

- Be over 18 years

- Have a national ID

- Possess an Android phone

- Have a registered MPESA line

- Have a good credit rating

AsapKash loans generally attract a maximum APR of 18%, and you’ve 91-365 days to pay back.

Registration and Application

Here’s how to get started:

- Download AsapKash from Google Play and install it

- Sign up for an account

- Fill out the application form with personal information and then submit it to complete the registration

- Log into your account to see how much you qualify for and apply

- Wait to receive the money on your phone

All payments are through the pay bill number 4047993. They, however, don’t specify the penalty for late payments on their app or website, but given what other apps charge, it shouldn’t be more than 2% daily.

25. Apesa Loan App

Completing our list of best loan apps in Kenya is Apesa. Apesa is a reliable, worry-free loan app that promises safe lending to its users. Managed by Xerox Technology Company Ltd, Apesa offers Ksh 500-Ksh 8,000.

After making the payments, all of its loans are renewable, and you can even qualify for a higher limit.

Requirements

Generally, you should meet these requirements to be eligible for an Apesa loan:

- Be over 18 years

- Own an Android smartphone

- Have a good credit rating

- Have a registered MPESA line (at least six months active)

Apesa offers you 91-365 days to pay back the loan, attracting a maximum APR of 18%. The daily interest, however, is 0.06%. All Apesa loan payments are through the pay bill number 4047993.

Registration and Application

Here’s how to get started with Apesa:

- Download Apesa from Google Play and install it

- Launch it on your phone and register for an account

- Wait to see how much you qualify for and apply

- Wait to receive money in your MPESA

Also Read: Emergency Loans in Kenya via MPESA

In Conclusion

The 21st Century Kenya is experiencing a real-time financial revolution with the advent of online money lending apps. The above 10 are some of the best loan apps in Kenya.

All of them provide instant loans. No paperwork. No long processes – just your phone and internet (some even have USSD codes) and you are good to go.

Make a decision today and choose your favorite.