Launched in 2018 by Finberry Capital Limited, the Berry Loan App is slowly warming its way into the hearts of Kenyan mobile loanees. With the app promising a minimum of Ksh 1,000 and a maximum of Ksh 50,000 straight into your MPESA wallet, there’s every reason for Kenyan borrowers to get excited.

But wait for a second! The monthly facilitation fee is 9-25% of your principal amount, and the annual percentage rate (APR) is 27-260%.

Yes, that’s how steep the fees are! And mark you; you have up to 65-121 days to pay up. Failure to do so attracts a 10% fee on top of the amount payable, among other penalties.

But overall, Berry promises fast loan disbursement, flexible repayments, among other benefits.

Let’s learn more about the app and how it works. But if you are in a hurry, check out a table overview of the mobile loan app below.

Berry Loan App Overview

| Download | Google Play |

| Website | Berry.ke |

| Owner | Finberry Capital Limited |

| Loan Limit | Ksh 1,000-Ksh 50,000 |

| Monthly Facilitation Fee | 9-25% of the principal amount |

| Annual Percentage Rate | 27-260% of the principal amount |

| Penalty | 10% of the principal amount |

| Repayment Period | 65-120 days |

| Repayment Extension | 7 days |

| Paybill Number | 977888 |

| Size | 4.41MB |

About the Berry Swift Loan App – How it Works

Berry App is a product by giant digital lender Finberry Capital Limited. This app was launched on November 20, 2018, and is available for download on Google Play. Its size is 4.41MB.

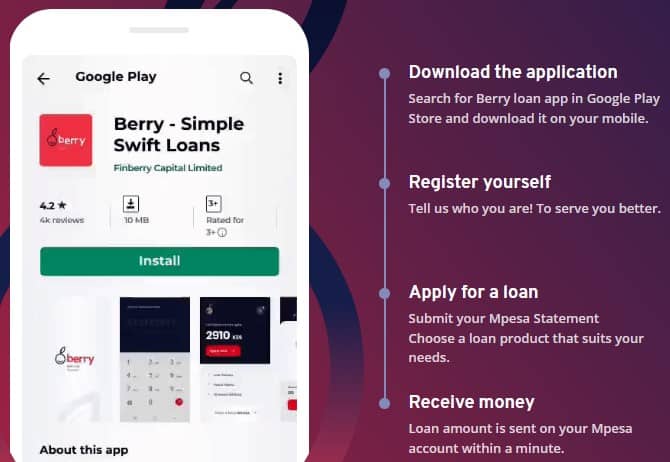

Here’s how the Berry App works:

- First, install the Berry App on your phone

- Wait to receive an OTTP message, which you should enter to initiate the application

- Create a unique 4-digit password and confirm it

- Click ‘Apply Now’ on the app

- Pick the payment tenure and then the repayment date

- Click Ok to confirm

Berry Loan App Application Requirements

Before you can apply for a Berry loan, you need to meet the following requirements:

- Be at least 18 years

- Own an Android smartphone

- Possess a Kenyan I.D or passport

- Have an active MPESA account

- Have internet access

- Enjoy a good credit score

Berry Loan App Free Download

Downloading the Berry loan app is hustle-free. You only need to follow these steps:

- Visit Play Store on your Android phone and search for ‘Berry Loan App’

- Once the app pops up, click download

- Then click install to install it on your phone

- Once the app installs successfully, open it to complete the registration

How to Successfully Register for a Berry Loan Account

Important Note:

Berry collects personal information on your phone and the device information before disbursing a loan to you. The information includes technical data such as the device’s IMEI, operating systems, phone’s model, SIM card information, location, and time.

Berry also collects personal information such as phone contacts, SMS, MMS, call logs, and photos

Once you allow Berry access to the personal and technical information, you should follow these steps to register:

- First, download and install Berry on your phone

- Input the OTTP that Berry sends to you once you install the app

- Reset your password

- Enter your I.D number and name

- Enter your referral code if someone referred you

- Click ‘Register’

- Pass an eye test to confirm that you are human

How to Apply for a Berry Loan

Once you successfully register for a Berry account, you can go ahead and apply for a loan limit that you qualify for. The process is simple, and it entails:

- Launch Berry app

- Select sign up and then enter your phone number

- Enter the OTP sent by Berry and create a unique 4-digit PIN

- Log in to the app and select a loan that you qualify for

- Agree to the terms of the loan

- Wait for about 2 minutes for the loan to be sent to your phone

Berry Loan Limit

Berry offers loans from Ksh 1,000 up to Ksh 50,000, depending on your credit score and Berry history. So, it’s critical to have a good credit record and avoid CRB listing if you want to get a good loan on Berry App.

How to Increase your Berry Loan Limit

You can increase your Berry loan limit by following these steps:

- Keeping the app on your phone and using it often

- Paying back the loans on time

- Borrowing frequently

- Retaining a good credit score

- Regularly transacting using MPESA and keeping the MPESA messages

Berry Loan Interest Rates

Berry gives loans that attract a monthly facilitation fee of 9-25% of your principal amount. The rate depends typically on the following:

- Loan amount

- Payment period

- MPESA transactions

Annually, the loans attract an APR (annual percentage rate) of 27-260%, depending on the loan amount.

Berry Loan Repayment

Here are the routes for repaying your Berry loan:

- The App Route

- Go to your Berry app

- Click ‘Pay Now’

- Proceed with the steps

- The MPESA Route

You need to follow these steps:

- Open the MPESA menu

- Go to Lipa na MPESA

- Select Pay Bill and enter the Berry Loan App Paybill Number (977888)

- Then, put your Safaricom number as the account number

- Enter the amount you want to repay

- Input your MPESA Pin

- Press Ok after confirming the details

Important Note

Once you take up a Berry loan, you have up to 65-120 days to pay the loan. However, in the case of the first loan, Berry typically offers you up to 30 days to pay the loan entirely.

Penalties for Late Repayment

Failure to pay your Berry loan on time results in an additional 10% fee of your outstanding amount. But before they penalize you, Berry offers you a 7-day grace period to repay the loan.

But once the grace period elapses and you fail to pay the loan, Berry can resort to forwarding your details to CRB (Credit Reference Bureau), where you are blacklisted. That denies you the opportunity to get a loan from other lenders.

What Should I Do If My Payment Doesn’t Reflect?

If you don’t receive a confirmation message from Berry within two hours after repaying your loan, you can contact Berry customer support. You’ll also need to copy and paste the MPESA confirmation message and forward it to customer support.

The message must include the MPESA transaction code, amount paid, time, date, and account (phone number).

The support team will then retrace the payment and get back to you with a response.

Berry Loan App Contacts

If you want to make inquiries or are facing challenges with the app, you can contact Berry customer support through the contact form on their website.

Alternatively, you can use any of these routes:

- Facebook – @berryappke

- Email – support@berry.ke

- Twitter – @berryappke

- Physical Location – Finberry Center on Chaka Road

Pros and Cons of the Berry Loan App in Kenya

The Pros

Here are the benefits that come with using the Berry mobile loan app:

- Quick loan disbursement to your MPESA

- Excellent customer support

- 7-day grace period

- No hidden charges

- No paperwork or collateral

- The loan application process is seamless

- Berry allows partial loan repayments

The Cons

While Berry App offers some attractive benefits, there are a few worrying concerns. For one, their monthly 9-25% facilitation fee is expensive, especially if you consider the higher end (25%). Their APR is even more concerning, given that you can pay up to 260%.

Also, Berry collecting your phone’s technical and personal information and potentially using it is worrying. But other than that, there isn’t much to bother you as a user.

People Also Ask

1. Is Berry Loan App Legit?

Berry has a physical location, which proves they are a legit firm. Secondly, the customer review sections indicate that the loan app is legit as you can read real customer feedback.

2. How Do I Apply for A Berry Loan?

You first need to download the Berry App from Google Play Store and install it on your phone. Then, you should set up your profile before applying for the loan.

3. What Happens If I Overpay My Loan?

If you mistakenly overpay your loan, your Berry wallet will reflect the excess amount. That means you can withdraw it to your MPESA.

4. Can Berry Extend My Repayment Date?

Unlike most loan apps, Berry can extend your loan repayment date by seven days. But once the seven days are over, Berry will result in charging you a 10% fee on top of what you already own.

5. Can I Download Berry On My iPhone?

Unfortunately, NO! Berry is only available on Android. They, however, say they’ll be considering other platforms in the future.

6. Does Berry Have a USSD Code?

Unfortunately, there is no Berry Loan App USSD code for applying for the loans and repaying them. So, if you don’t have an Android smartphone to download the app, it’s not possible to get a Berry loan at the moment.

7. How Quick Can I Get a Berry Loan?

Berry disburses loans into your MPESA in about 2 minutes. But first, you have to register and earn their approval before getting a loan from them.

8. Why Did Berry Reject My Loan Application?

If Berry fails to grant your loan, the chances are that you didn’t convince them with your personal information, or you have a bad credit score. It could also be because your phone details are already registered in their system. So, the best you can do is contact them.

Also Read:

Closing Remarks on the Berry Loan App!

Though Berry is a new entrant into the Kenyan mobile loan app market, the company is slowly winning its way into the hearts of Kenyan borrowers.

Overall, there is more to understand before applying for a loan. That includes the fees, repayment period, penalties, and other information I’ve covered above.