Today, we have many loan apps in Kenya without registration fee. So, gone are the days you needed to physically visit a Sacco or bank to get a quick loan to settle an emergency or, worse, have to pay something for registration.

All you need is to own a smartphone, access the internet, possess a valid ID, have an active Safaricom line that must have been in use for the past six months, and be at least 18 years.

You can download these loan apps from Google Play and get the convenience of instant loans to MPESA anytime in Kenya. And since you no longer have to pay for the registration, the process is seamless.

This guide will unveil to you not only these loan apps but also the process of applying for the loan, the interest rates, duration, and the loan limits.

Later, I will also answer some questions relating to the loan apps.

But first, below is a table summary of these exciting loan applications:

8 Best Loan Apps In Kenya Without Registration Fee

| Loan App | Duration | Interest Rate | Loan Amount |

| Tala | 61 days | 4% – 34% | Ksh 1,000 – Ksh 30,000 |

| Haraka | 91 – 365 days | 1.3% – 16% | Ksh 500 – Ksh 60,000 |

| Bayes | 90 – 180 days | 30% | Ksh 1,000 – Ksh 50,000 |

| Branch | 62 – 336 days | 1.6% – 20% | Ksh 250 – Ksh 70,000 |

| Timiza | 30 days | 6% | Ksh 500 – Ksh 100,000 |

| Mokash | 91 – 365 days | 16% | Ksh 2,000 – Ksh 10,000 |

| Direct Cash | 91 – 365 days | 1% – 9% | Ksh 1,500 – Ksh 50,000 |

| Lion Cash | 91 – 365 days | 16% | Ksh 2,000 – Ksh 10,000 |

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

Best Loan Apps In Kenya Without Registration Fee Reviewed!

Here are the top 8 loan apps that give unsecured loans without a registration fee:

1. Tala Loan App

Tala offers credit to their eligible clients instantly to their MPESA account. The loans attract lower interests than other online lenders, averaging 4% – 34%. However, late repayments incur a one-time penalty of 8% of the outstanding loan amount.

Depending on eligibility, Tala offers Ksh 1,000 – Ksh 30,000, payable within 61 days at most. Remember, your limit grows when you frequently borrow from Tala and repay your loan on time.

How it Works

Here’s how to get a loan from Tala:

- Download the Tala loan app from Google Play

- Fill in all the required fields and apply for the loan you want

- Get approved and receive your loan to your MPESA wallet instantly

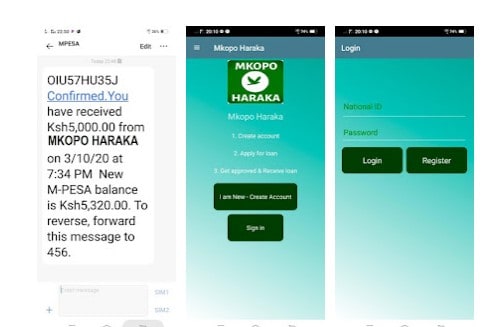

2. Haraka Loan App

Living up to its Swahili translation, which means ‘fast,’ Haraka offers quick loans to MPESA without any paperwork. Depending on eligibility, Haraka loans you Ksh 500 – Ksh 60,000, which you should pay within 91-365 days.

Haraka mobile loans attract a monthly interest rate of 1.3%, while the annual loans accumulate an interest rate of 16%.

The good news is that Haraka does not charge any service fee on all their loans.

How it Works

Here’s how to get an Haraka loan:

- Download the Haraka loan app from the Google Play Store

- Create an account using your Facebook details

- Fill in all the fields and apply for the loan amount you qualify for

- Wait to receive the loan instantly to your MPESA account

3. Bayes Loan App

Bayes, a product of Pi Capital Limited, is available on Google Play and via USSD.

The lender offers you Ksh 1,000 – Ksh 50,000, which attracts a 30% interest rate on the principal loan amount.

Bayes also has a flexible repayment tenure of 90 – 180 days.

Suppose you want to get the loan using the USSD code, dial *879*99#, and follow the steps that follow.

How it Works

Here’s how to get a loan from Bayes:

- Download the Bayes loan app from Google Play

- Launch the loan app on your phone and create your account

- Accept Bayes’ terms and conditions

- Set a four-digit pin

- Navigate the loan icon and borrow the amount you need

- Submit your application and wait for approval and disbursement to your MPESA account

4. Branch Loan App

Branch gives instant MPESA loan of about Ksh 250 – Ksh 70,000, payable within 62 to 336 days. The loans usually attract a monthly rate of 1.6% – 20%, depending on how much you borrow.

How it Works

Here’s how to get a Brand loan:

- Download the branch loan app from Google Play

- Create an account by login into your Facebook account,

- Apply the loan amount you qualify for

- Wait for disbursement, which takes a few minutes

5. Timiza Loan App

Timiza, part of Absa Kenya, offers Ksh 500 – Ksh 100,000 quick loans, payable in 30 days. All Timiza mobile loans incur interest of 6%.

The better part of Timiza loans is that they are also available to iPhone users, and so you can flawlessly download the app from your phone’s apple store.

Not only does Timiza lend money to its customers, but it also allows you to save with them. Furthermore, you can use the Timiza service to purchase your insurance, airtime and pay your bills like TV subscriptions and KPLC.

Overall, the loan approval is quick.

How it Works

Here’s how to get a Timiza loan:

- Download the Timiza app from the Google Play Store or App Store

- Install and launch the app on your phone

- Register using your details and agree to the app’s terms and conditions,

- Select the loan amount you need, and submit your application

- Upon approval, the loan will be deposited into your Timiza account

- Transfer the loan from your Timiza wallet to your MPESA

More Instant Loan Apps in Kenya Without Registration Fee

6. Mokash Loan App

Mokash promises quick loans to its customers nationwide without any hidden service charge. The lender also falls in the category of the best loan apps in Kenya without registration fee and CRB check.

Generally, the Mokash loan app collects your phone’s data, including your text messages and contact list, to determine your eligibility.

Depending on eligibility, you can borrow Ksh 2,000 – Ksh 10,000, payable in 91 – 365 days. The short-term loans incur interest of 6%, while the yearly loans attract a 36% interest.

How it Works

Here’s how to get a loan from Mokash:

- Download the Mokash loan app on Google Play

- Grant the app all the necessary permissions and agree to the terms

- Set a four-digit passcode and check your loan limit

- Apply for the amount you need and wait for the disbursement to your MPESA

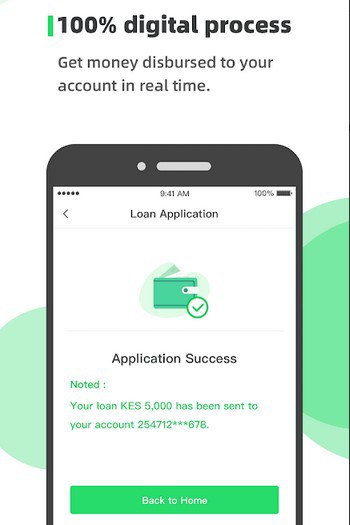

7. Direct Cash Loan App

If you are looking for a legit and flexible loan app in Kenya that charges no registration fee, Direct cash should be on top of your list.

The registration process is easy as well as the loan application process. The loan disbursement to your MPESA account takes less than 5 minutes.

Direct cash loans from Ksh 1,500 to Ksh 50,000 with 91 – 365 days repayment period.

The short-term loans incur an interest rate of 1% – 9%, while the yearly loans attract a 36% interests rate.

However, the loans are available to everyone within the age bracket of 18 to 60 years.

How it Works

Here’s how to apply for a Direct Cash loan:

- Download the app from Google Play and install it on your phone

- Launch the app and register using your Safaricom line and fill the required fields

- Apply for the loan and wait for the approval

8. LionCash Loan App

LionCash provides you with emergency loans in Kenya via MPESA. The sign-up process is straightforward, and you’ll receive the loan directly to your MPESA.

However, you have to be within the age bracket of 20 – 60 years. LionCash offers quick loans of Ksh 2,000 – Ksh 10,000 with a tenure period of 91 – 365 days, and the APR interest rate is 16%.

LionCash loan repayment is flexible as you can make partial payments before the due date.

How it Works

- Download LionCash from the Google Play Store

- Register using your Safaricom line,

- Apply for the loan you qualify for

- Wait to receive money directly to your MPESA account

People Also Ask

1. Can I Get a Loan When Listed with CRB?

It is possible to get a loan while still listed by the Credit Reference Bureau. Though you may not get a loan with SACCOs and banks, many mobile online lenders give unsecured loans at the convenience of your home.

However, for the apps to reach a lending decision, they collect your phone’s data and personal information.

2. How to Get a Loan Online in Kenya?

If you want to get a loan online, you need to own a smartphone and access mobile data. You also need to be 18 years or more and have a valid national ID.

On top, you need an active Safaricom line that must have been in use for the past six months or so.

3. What Are The Best Instant Loan Apps In Kenya Without Registration Fee?

The best loan apps include Tala, Haraka, Bayes, Branch, Timiza, Mokash, Direct Cash, and LionCash.

You can try any of the above to settle your pressing need but repay your loans timely to increase your loan limit and avoid penalties.

Also Read:

Emergency Loans in Kenya Via MPESA

Closing Remarks on Loan Apps in Kenya Without Registration Fee!

Above are loan apps in Kenya that do not charge any registration fee when giving you a loan.

Remember, these are just a few as more loan apps are under creation and development each day.

All you need is to download any of your choices and apply for the loan anytime.