Financial emergencies are almost unforeseen with the volatile Kenyan economy, and mobile lenders are becoming a norm. Interestingly, many of these lenders are quick to offer emergency loans in Kenya via MPESA, provided you meet their minimum requirements.

Often, all you need is an ID, a clean credit record, and a registered MPESA line. Sounds easy, right? Well, wait till you hear about the rates and terms.

These lenders give you quick loans because they expect you to pay high interests of up to 10-15% within a month or an annual percentage rate (APR) of about 25-36%. Failure to beat their deadlines results in extra charges and not forgetting the service fee.

So, familiarize yourself with the various mobile lenders, their rates, and terms, and that’s where this article comes in.

I’ll review 13 lenders you can run to for quick emergency loans.

I should insist, nonetheless, that the keyword is emergency. If it’s betting, getting the trendiest watch, taking a girlfriend out, or any other thing that doesn’t sound like an emergency, just drop it to avoid paying unnecessary fees or CRB blacklisting.

Let’s discuss these mobile lenders and their loan terms in detail.

In a hurry? Check out a summary of these lenders and their current offers below:

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

Table Summary of the Best Emergency Loans in Kenya Via MPESA

| Loan App | Loan Amount | Repayment Period | Interest Rate |

| Tala | Ksh 2,000 – Ksh 30,000 | 21-30 days | 11-15% |

| Timiza | Ksh 50 – Ksh 150,000 | 30 days | 1.17% |

| Branch | Ksh 250 – Ksh 100,000 | 4-52 weeks | 17.35% |

| Zenka | Ksh 500 – Ksh 30,000 | 61 days | 70.7 – 224.89% (APR) |

| Haraka | Ksh 500 – Ksh 5,000 | 7-31 days | 23.45% |

| Opesa | Ksh 1,500 – Ksh 50,000 | 91-365 days | 36% (APR) |

| Okash | Ksh 500 – Ksh 50,000 | 91-365 days | 36% (APR) |

| Fuliza | Ksh 1 – Ksh 70,000 | 30 days | Ksh 2 – Ksh 30 daily |

| Zash | Ksh 500 – Ksh 50,000 | 91-365 days | 25% (APR) |

| Mokash | Ksh 2,000 – Ksh 10,000 | 91-365 days | 36% (APR) |

| Eazzy | Ksh 100 – Ksh 200,000 | 30 days | 2-10% |

| KCB MPESA | Ksh 50 – Ksh 1M | 30 days | 8.64% |

| M-Shwari | Ksh 100 – Ksh 50,000 | 30 days | 7.5% |

Emergency Loans in Kenya Via MPESA Reviewed!

Here are 13 quick emergency loans in Kenya:

1. Tala Emergency Loans

Formerly Mkopo Rahisi, Tala has grown tremendously in the past five years to become one of the pacesetters in the Kenyan mobile market. The lender prides on its fast loan disbursement, flexible rates, and supportive customer desk. Even better, Tala is one of the few loan apps in Kenya that lends without a registration fee.

You can download Tala, register, and request a loan in just 5 minutes, and you can get Ksh 2,000 – Ksh 30,000, depending on eligibility, and pay within 21 days or 30 days.

If you select a 21-day repayment, you will pay a lower service fee than the 30-day repayment option. The service charge is 4% – 14% of the loan amount.

However, all Tala loans attract 11-15% interest, depending on the amount and tenure, and all late repayments attract an 8% penalty.

Requirements

Below are Tala loan eligibility requirements:

- Be at least 18 years

- Active MPESA account

- Android smartphone

- Valid Kenyan ID

- Good CRB record

Registration and Application

Here are the steps for applying for Tala emergency loans:

- Download the Tala loan app from Google Play

- Launch the app and sign up with your details

- Go to loan and apply for the amount you qualify

- Wait for disbursement to your MPESA, which takes minutes

2. Timiza Online Emergency Loans Kenya

Barclay’s Timiza is one of the lenders with the best offers and rates in Kenya. Depending on eligibility, the offer starts from Ksh 50 to about Ksh 150,000, and you’ve up to 30 days to pay.

Incredibly, Timiza only charges 1.17%, which is just insane. You’ll, however, incur a 5% facility fee. Overall, if you are prompt with your payments, Timiza will likely raise your limit faster than most lenders.

Requirements

The minimum eligibility requirements for applying for Timiza loans include:

- Registered Safaricom line

- Good CRB record

- Kenyan ID

- Active MPESA account

Registration and Loan Application

Here are the steps for applying for Timiza quick loans:

- Download the app from Google Play

- Launch the app on your phone

- Sign up using your details

- Go to loans and apply for your limit

- Apply and wait for reimbursement to MPESA

3. Branch Quick Online MPESA Loans

Branch is another reputable mobile lender with good offers for Kenyan online borrowers. Depending on eligibility, Brand offers Ksh 250 – Ksh 100,000, payable within 4-52 weeks and attracting a 17-35% interest rate.

Branch is strict on loan repayments, and though they don’t penalize the penalty on the app, the rates are hefty, according to customer reviews. So, it’s best to pay on time.

Requirements

Here are the basic eligibility requirements for Branch mobile loans:

- Valid Kenyan ID

- Android smartphone

- Registered Safaricom number

- Active MPESA account

- A working Facebook account

- Good credit record

Registration and Loan Application

Follow these steps to download Branch and apply for a loan:

- Download the Branch app from the Google Play store

- Install the lending app and launch it on your android phone

- Create an account by filling in your details

- Select the loans option and apply

- Wait for disbursement to your MPESA account

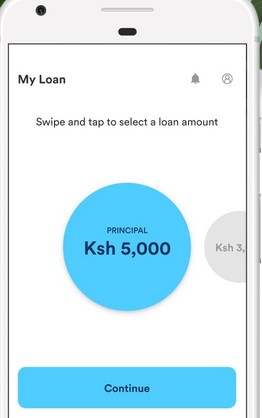

4. Zenka Emergency Loans in Kenya Via MPESA

Zenka promises an interest-free first loan to its first customers. But before you can jump off your shoes, you should note that the loan only applies to your first 24 hours of applying. So, if you don’t pay the loan back within a day, the usual interests apply.

Speaking of interests, Zenka charges an annual percentage rate of 70.7 – 224.89%, and you can borrow Ksh 500 – Ksh 30,000, depending on eligibility.

Overall, Zenka offers you up to 61 days to pay its loans, but you can always do it in installments before your due date.

Requirements

Here are the minimum requirements for applying for a Zenka emergency loan:

- Registered Safaricom line

- Active MPESA account

- Android smartphone with internet access

- Kenyan ID

Registration and Loan Application

Follow these basic steps to sign up and apply for a Zenka instant loan:

- Download the Zenka loan app from Google Play

- Sign up using your Safaricom number and your official names

- Accept the loan terms

- Navigate the loans section and select the amount you want to borrow

- Wait for the disbursement to your MPESA account

5. Haraka Quick MPESA Loans

We cannot talk about emergency loans in Kenya without mentioning Haraka. Just as their name suggests, Haraka promises quick phones straight into your MPESA wallet for your emergencies.

You can borrow from Ksh 500 to Ksh 5,000 with the Haraka loan app. The best part is that your limit is subject to increase if you repay your loan on time, borrow frequently, and regularly use Safaricom and MPESA services.

All Haraka loans attract 23.45% interest and are payable within 7-31 days.

Requirements

Here are the minimum requirements for getting a Haraka instant loan:

- Active Facebook account

- Valid Kenyan ID

- Android smartphone

- Registered MPESA line

- Good CRB record

Registration and Loan Application

Follow these steps to download and apply for an Haraka emergency loan:

- Download the Haraka loan app on the Google Play store

- Install and launch the Haraka app on your phone

- Register by using your Facebook account

- Navigate the app to the loans section and request the loan amount you qualify for

- Wait for the disbursement on your phone

6. Opesa Emergency Loans in Kenya Via MPESA

Enjoying a million-plus download on Google Play, Opesa is one lender that every Kenyan craves. Essentially, that’s because the registration process is straightforward, and the loan disbursement is quick.

You can borrow Ksh 1,500 to Ksh 50,000 and repay within 91 – 365 days, attracting an annual interest rate of 36%.

However, Opesa charges a service fee between Ksh 100 – Ksh 600, which depends solely on the loan amount.

Overall, failure to pay the loan in time triggers a 2.4% daily penalty by Opesa.

Requirements

Here are the minimum requirements for applying for an Opesa quick loan:

- 18 – 55 years

- Valid Kenyan ID

- Active Safaricom line

- Working MPESA account

- Good CRB score

- Android smartphone with internet access

Registration and Loan Application

Follow these steps to apply for an Opesa emergency loan:

- Download the Opesa app from your Google Play store

- Install the app and launch it on your phone

- Sign up by agreeing to the terms

- Apply for the loan amount you qualify

- Wait for disbursement to your MPESA account

7. Okash Emergency Loans

Okash, popularized by Giant One Spot Technology, is another Kenyan mobile lending leader. Depending on eligibility, the mobile lender offers Ksh 500 – Ksh 50,000, and all its loans are payable within 91-365 days.

Okash loans attract a 36% APR rate, but before the loan is granted, you need to pay a service fee of between Ksh 100 – Ksh 3,000, which varies according to the loan amount you borrow.

If you fail to repay your Okash loan on time, you will have to pay a 2% daily penalty.

Requirements

Here are the basic application requirements for Okash mobile loans:

- Be at least 18 years and above

- Registered Safaricom line

- Active MPESA account

- A smartphone with accessibility to the internet

- Valid Kenyan ID

Registration and Loan Application

Apply for an Okash loan using these steps:

- Download Okash from Google Play

- Launch the Okash app on your phone and sign up with personal details

- Apply for the loan and wait for disbursement, which takes a few minutes

8. Fuliza Emergency Loans

Imagine wanting to buy something without enough funds in your MPESA account. Well, you don’t have to imagine anymore as Fuliza comes in handy in such desperate times.

It helps you complete your transactions seamlessly without people knowing of your inadequacy.

Fuliza lends emergency cash between Ksh 1 and Ksh 70,000 to Safaricom users, payable within 30 days. The charges range from Ksh 2 to Ksh 30 daily, depending on the loan amount.

The only setback is that you cannot withdraw Fuliza. However, you can do everything else, including sending money, paying bills, and buying airtime.

Requirements

Here are the basic eligibility requirements for Fuliza loans:

- Registered Safaricom line

- An active MPESA account (at least six months old)

- Good credit record

- Good record of paying Okoa Jahazi

Loan Application

Here’s how to apply for a Fuliza emergency loan:

- Dial *234# on your phone

- Select option 0 (Fuliza na MPESA option)

- Agree to Fuliza terms by selecting option 1

- Opt into Fuliza services, and you will see your limit

- Transact when you don’t have enough money, and you’ll be asked if you want to complete the transaction with Fuliza

- Opt to do it, and that’s it

9. Zash Instant Mobile Loans in Kenya

Zash is another lender drawing the masses due to its incredible offers and flexible terms. Depending on eligibility, Zash allows you to borrow from Ksh 500 to Ksh 50,000 and pay within 91-365 days.

The loans attract a 25% APR, and the sweetest part is that Zash allows you to extend your repayment period.

Requirements

Here are the eligibility requirements for applying for Zash emergency loans:

- Be 18-60 years

- Android smartphone

- Registered Safaricom line

- Active MPESA account

- Valid Kenyan ID

- Access to the internet

Registration and Loan Application

Here’s how to download and apply for a Zash quick loan:

- Download and install Zash from Google Play

- Launch the Zash app on your phone and sign up with your details

- Accept Zash loan terms

- Apply for the loan you qualify for and wait for disbursement to your MPESA

10. Mokash Quick MPESA Loans

Mokash is one of the few loans apps without a CRB check in Kenya. So, consider it if the CRB has blacklisted you and cannot get a loan from the other lenders.

Mokash offers you loans starting from Ksh 2,000 to Ksh 10,000, and they are payable within 91-365 days. The loans, however, attract an annual rate of 36%.

Requirements

- Be at least 18 years and above

- Kenyan national ID

- Registered Safaricom line

- Active MPESA account

- Android smartphone with access to the internet

Registration and Loan Application

Here’s how to sign up for a Mokash quick loan:

- Download the Mokash loan app from Google Play

- Sign up with your personal information

- Select the loan you qualify for and apply to

- Wait for the disbursement, which takes a few minutes

11. Eazzy Quick MPESA Loans

Equity bank offers you Eazzy quick mobile loans to settle your emergency if you have an equity account.

You can apply for the loan through your Equitel line through the USSD code *247# or by downloading the Eazzy loan app from Google Play.

The loans range from Ksh 100 to Ksh 200,000, payable within 30 days and attracting 2-10% interest.

To grow your Eazzy loan, you need to use the app frequently and repay the loans on time.

Requirements

Here are the basic requirements for applying for an Eazzy quick loan:

- Equity account

- An Equitel line

- Good CRB record

- Mobile phone (a smartphone if you want to download the app)

Registration and Loan Application

Follow these steps to sign up for an Eazzy quick mobile loan:

- Download the Eazzy app from Google Play

- Install the app and sign up with your details

- Select the ‘request loan’ option and pick the loan amount you want

- Submit your application and wait for disbursement

Note that Eazzy loans are deposited to your Eazzy account. So, you need to first transfer to your MPESA account before the withdrawal.

12. KCB MPESA Quick Online MPESA Loans

In partnership with Safaricom, KCB Bank offers loans to customers ranging from Ksh 50 to Ksh 1Million, depending on eligibility.

The loans have a repayment span of 30 days, and they attract an interest rate of 8.64%.

Requirements

Here are the eligibility requirements for KCB MPESA loans:

- Registered Safaricom line

- A good credit rating

- Kenyan ID

Loan Application

You can opt to download the app from the play store, launch it, and sign up for the loans.

Alternatively, you can follow the steps below if you don’t have a smartphone or prefers not to download the app:

- Go to MPESA

- Select loans and savings

- Choose KCB MPESA

- Check your limit and request the loan

- Wait for the loan disbursement on your phone

Note that the money gets deposited into your KCB MPESA account. So, you’ve to transfer it to your MPESA account.

Also Read: How to Get KCB Vooma Loan

13. Mshwari Instant Loans

Lastly, I’ve to talk about Mshwari, which most Kenyans are familiar with. Mshwari has a straightforward registration process and offers you Ksh 100 to Ksh 50,000 at an interest rate of a 7.5%.

The loans are payable within 30 days. Mshwari offers you a 30-day extension, subject to a small charge for failure to beat their deadline.

Requirements

Here are the basic eligibility requirements for Mshwari loans:

- Active Safaricom number

- MPESA account

- Good credit record

Loan Application

Follow these steps to apply for a Mshwari loan:

- Go to MPESA on your mobile phone

- Choose loans and savings

- Pick Mshwari option

- Activate your Mshwari account

- Request for the loan limit you qualify

People Also Ask (About Emergency Loans in Kenya Via MPESA)

1. How Can I Get a Quick Loan in Kenya?

It’s easy getting a loan in Kenya. All you need is an active MPESA account, a registered Safaricom line, and an android phone. Once you get all this, find the best loan apps in Kenya and apply for a quick loan.

2. Where Can I Borrow Money Urgently in Kenya?

Some of the best mobile lenders in Kenya include Tala, Mshwari, KCB MPESA, Okash, Zash, Timiza, Brand, and Opesa.

3. How Can I Get a Loan Without an App?

Some Kenyan lenders allow you to get quick mobile loans with USSD codes. So, you don’t need an app.

Also Read: How to Make 10K Fast

Closing Thought On Emergency Loans in Kenya Via MPESA!

It’s generally easy to get an emergency loan in Kenya if you meet the basic requirements shared above. It’s, however, more important to know the applicable terms and ensure you pay on time. And like I mentioned, only borrow when it’s an emergency, and you have no other way to get the cash quick