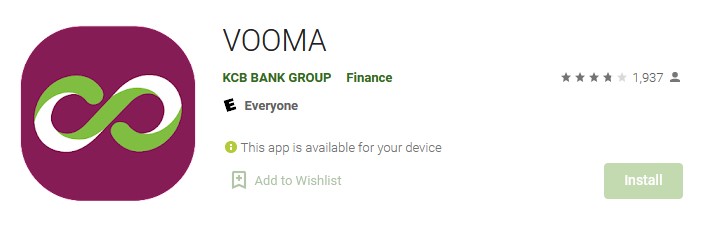

Kenya Commercial Bank (KCB) is one of Kenya’s most reputable money lenders. They not only offer KCB MPESA services to mobile borrowers but also have Vooma loans. Yet, not many know how to get Vooma loan.

You can get a Vooma loan using the Vooma loan app, available for download on Google Play or App Store. Alternatively, you can access the loans using the USSD code *844#. All options allow you to borrow Ksh 1,001 – Ksh 300,000, depending on your eligibility.

Vooma loans are available to all using smartphones and Kabambe phones. And since you can choose to access the loan via USSD or app, flexibility is king. But given that it’s a KCB product, not everyone qualifies.

I’ll highlight the eligibility requirements and the process of obtaining the loan. I’ll also discuss the rates, limits, repayment, and tips for securing higher limits.

But if you are in a hurry, below is Vooma loan’s overview:

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

| Download | Google Play or App Store |

| USSD Code | *844# |

| Lower Limit | Ksh 1,001 |

| Higher Limit | Ksh 300,000 |

| Interest Rate | 6.91%. |

| Service Charge | None |

| Payment Term | 30 days |

| Website | www.VOOMA.com |

Let’s get started with the two ways you can get Vooma loans.

How to Get Vooma Loan

Getting a Vooma loan is easy. You can apply either using the Vooma loan app or the USSD code *844#.

Let’s discuss the two options:

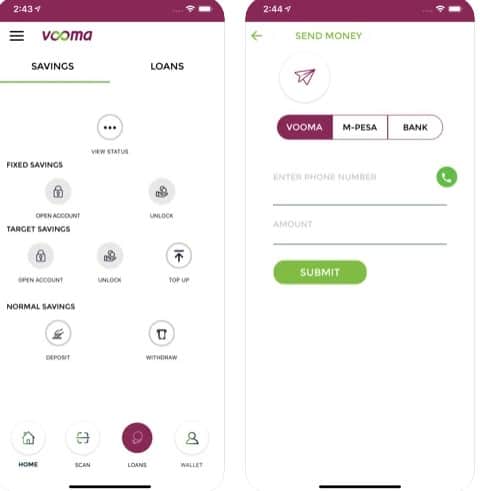

Using the KCB Vooma loan App

Before applying for a Vooma loan using the app, you must first download the app on Google Play or App Store. After downloading and installing Vooma on your phone, the next step is to sign up for an account.

Here’s how to register Vooma loan account:

- Open Vooma on your phone

- Enter your phone number

- Read theVooma loan terms and conditions, then accept them

- Grant Vooma the permission to access your contacts, SMS, camera, photos, calendar, location, and phone ID

- Enter your ID number and names in the relevant boxes

- Create a 4-digit pin that you can remember and confirm your pin

- Wait for a few minutes for the app to verify your details

Once verified, you will receive a message welcoming you to Vooma. You can then log into your account and apply for the loan you qualify for. Of course, that is after meeting the eligibility requirements, which I’ll share later.

Using the Vooma KCB USSD Code

If you use a Kabambe phone or have issues with your loan app, you can still sign up for a Vooma loan and borrow from the lender.

Here are the steps to follow:

- Dial *844# on your mobile

- Choose ‘Loans and savings’ and then Vooma loan

- Select the loan request option

- Enter the amount you want to borrow

- Wait to receive your loan in your KCB MPESA account

Vooma Loan Limit

Vooma loans range from Ksh 1,001 to Ksh 300,000, which is impressive. But if you are newly registered, you should expect to start with a smaller loan limit. Nonetheless, the chances of building trust with Vooma and increasing your loan limit are higher when you stay loyal and pay on time.

How to Qualify for Vooma Loan (Eligibility Requirements)

Before applying for a Vooma loan, you must meet the following:

- Possess a Kenyan ID/Allen ID

- Have a registered line – which must have been active for the last six months, at least

- Have an active KCB account – at least six months active

- Be a KCB mobile banking customer

Vooma Loan Interest Rate

According to kcbgroup.com, all Vooma loans attract a 6.91% interest. That is way better than most mobile loan apps in Kenya.

The other thing to note is that Vooma does not charge a service fee, and there are no additional hidden charges other than the monthly interest rate.

How to Increase Vooma Loan Limit

Vooma, like other online lenders, allows you to increase your loan limit over time. That is if you observe the following:

- Maintain a good credit score with the CRB

- Pay your Vooma loan on time

- Increase your KCB bank activity

- Borrow and save more with Vooma

How to Pay Vooma Loan from MPESA

Vooma loans have a payment tenure of 30 days. However, you can pay your loan in small installments before the due date.

You can choose to pay using the USSD code or KCB app when paying the loan. In the latter case, you must download the app on Google Play or the App Store.

Using KCB App

- Open the KCB app on your phone

- Choose loans

- Select Vooma loans

- Select repay

- Enter the amount you want to pay

- Choose pay from MPESA

- Enter your pin

- Confirm if all the details are ok before clicking ok

Using USSD code

- Dial *844# on your phone

- Choose loans and savings options

- Pick Vooma loan

- Choose loan repayment

- Enter the amount you want to pay

- Input your pin and submit

Note that if the due date passes before repaying your loan, Vooma will automatically deduct the loan amount from your Vooma savings.

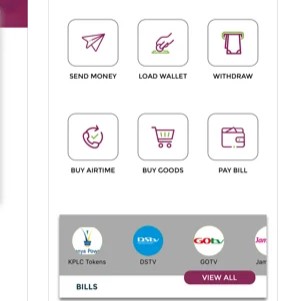

Vooma Services

Vooma is not just a loan app. It’s a one-stop solution for several services, which you may find beneficial. These services include:

Saving Services – Vooma allows you to set up a savings account and save up. Doing so boost your chances of getting higher loan limits from the lender.

Pay Bill Services – Once you have money on your Vooma account, you can settle your bills conveniently. You can use Vooma to pay for TV subscriptions and buy credit and KPLC tokens.

Buy Goods – Vooma allows you to buy goods and pay for them conveniently. That includes shopping, fuel, and dining services.

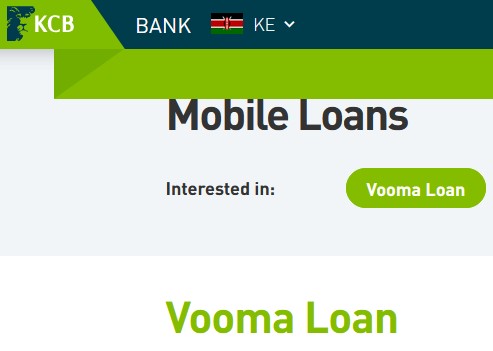

Send Money – Vooma also allows you to send money to your family and friends, registered or not registered with Vooma.

Usually, the money recipient receives an OTV code (a one-time voucher) that they should present to any KCB branch, Vooma agent, or KCB ATM within seven days to help them withdraw the money.

Deposit/Withdrawal Services – Like MPESA, Vooma allows you to deposit and withdraw your money anytime you want at the nearest Vooma agent or KCB branch.

Bank Transfers – You can also transfer money from your Vooma account directly to your bank account using PesaLink.

Standing Orders – Vooma also allows you to set standard orders using the USSD code *844#.

Pros and Cons of KCB Vooma Loan

Pros

Below are the advantages of the Vooma loan:

- You get a chance to save your money and pay bills

- You can also withdraw the funds

- Loan limits are decent (up to 300,000)

- You earn points (Simba points) every time you get a loan which you can redeem to earn other rewards.

- Flexible repayment (30 days)

- The interest rate is quite reasonable

- Lots of services other than borrowing money

- You don’t have to be a registered KCB customer

- Free joining and quick emergency loans in Kenya

Cons

- Your account must be active for the last six months

- You must have made four deposits and no withdrawals within the previous six months

Vooma Loan Contacts

Are you having issues with your Vooma account? You can reach customer care support using the contacts below:

- SMS: 22522

- Phone number: 0732 187 000 / 0711 087 000

- WhatsApp: 0711 087 087

- Website: www.VOOMA.com

- Email: contactcentre@kcbgroup.com

People Also Ask

1. What Is Vooma Loan?

Vooma loan is a product of KCB that gives mobile loans starting from Ksh 1,001 to Ksh 300,000. However, to qualify for a Vooma loan, you must be a KCB customer registered for the KCB mobile banking services.

2. How Long Does It Take to Get Vooma Loan?

After a successful application, your Vooma loan is deposited into your KCB account in minutes. Later, you can transfer the money to your MPESA account, where you can withdraw to the nearest MPESA agent.

3. Must I Be A KCB Member to Get a Vooma Loan?

Definitely YES! Vooma lends only to KCB customers who are also members of KCB mobile banking. You should be a member and own an active KCB account that has been in operation for the last six months and have at least four deposits to the account.

You, however, don’t have to be a KCB customer to access other Vooma services (send money, bank transfers, pay bills, and withdrawals).

4. How Can I Buy Airtime from My Vooma Account?

If you want to top up your Safaricom, Telkom, or Airtel line or even buy credit for a friend, you can do so by following the steps below:

- Open your Vooma app on your phone

- Choose buy airtime

- Enter your number or the number of whomever you want to buy airtime to

- Input the amount (in Ksh) you wish to purchase and submit

- Confirm if the transaction is correct

- Enter your Vooma pin and wait to receive airtime to your line in a few minutes

Alternatively, you can buy airtime using the USSD Code *844#. Just dial the code and select option 5 (buy airtime). Choose to buy from your Vooma wallet, and then enter the number you want to credit and follow the subsequent steps.

Closing Remarks On How to Get Vooma Loan!

You now know what it takes to get a Vooma loan and how much you can expect from the lender. But given that there is a lot to do with Vooma other than borrowing, this app is worth having. After all, it’s from KCB, one of Kenya’s most trusted banks.

With it, you can start saving to improve your loan limits. You can also pay bills, buy goods and airtime, and make bank transfers. What else would you want from a mobile banking service other than that? Besides, the service is accessible even by Kabambe holders