The Mokash Loan App was introduced into the Kenyan online lending market by MTN Rwanda in partnership with CBA (Commercial Bank of Africa) in 2017.

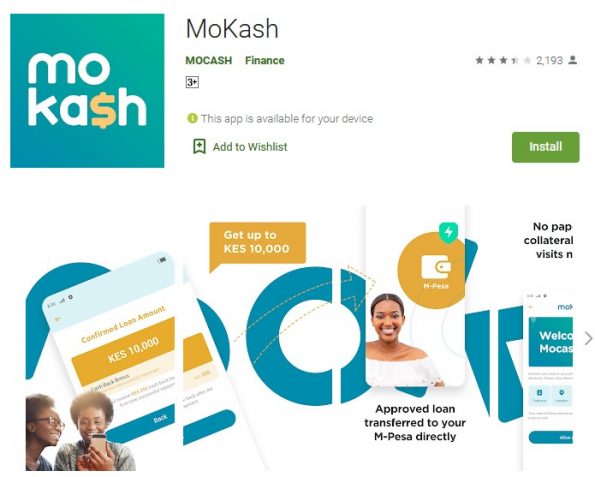

Since then, the app has become popular among Android users. Today, this mobile application enjoys over 500,000 installations on Google Play, confirming its popularity.

Mokash is known to promise higher loan limits of up to Ksh 30,000, depending on the loan amount and the client’s borrowing history and credit record.

One area where it seems to beat most of its competitors is not charging a service fee. That’s according to the app. It also has flexible terms and allows you to grow your limits faster.

But the question is, is it all rosy but not gloomy with Mokash? Should you borrow from Mokash? And if so, how should you go about it?

This guide shall answer all those questions to help you understand Mokash and know what you are getting into.

But first, let’s talk about the eligibility requirements.

If you are in a hurry, find below table summary of the limits, fees, penalties, repayment tenure, and other essential information about Mokash.

Mokash Loan App Table Summary of Loan Limits, Fees, Payment Duration etc.

| Lowest Limit | Ksh 2,000 |

| Highest Limit | Ksh 30,000 |

| Service Fee | Ksh 0 |

| Repayment Period | 8-14 days |

| Penalty | 2% daily |

| Interest | 20% |

| Download | Google Play |

How to Qualify for Mokash Loan (Eligibility Requirements)

Generally, Mokash expects you to meet these basic requirements before you can start applying for a loan:

- Be at least 20 years

- Have a valid Kenyan ID

- Own a registered Safaricom and MPESA line (active at least six months)

- Possess an Android smartphone as Mokash is only available for download on Google Play

Mokash Loan App Download

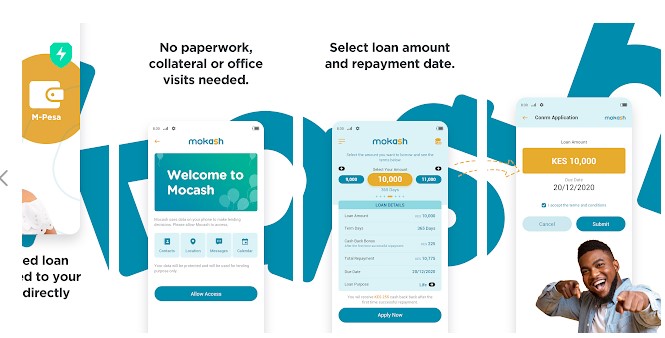

As mentioned, Mokash is only available on Android’s Google Play. So, go to Google Play and search for Mokash.

Once the app pops up in the search result, go ahead and download it.

Note that not only do you need an Android device, but its operating system should be at least Android 5.0.

Size-wise, the current app comes at 5.5MB, which is not much.

Mokash Account Registration

Once you meet Mokash’s eligibility requirements. You can set up your account using these steps:

- Launch the Mokash app on your phone

- Enter your MPESA phone number and wait for a verification code via SMS

- Enter the code to validate your number and then create your password

- Confirm everything before clicking ‘Done.’

- Grant Mokash access to your phone (discussed next)

- Fill out the application form with relevant personal, employment, and location information

- You’ll also need to provide two emergency contact numbers

- Agree with the terms to complete the registration

Mokash App Permission and Data Collected

You are probably wondering, ‘why should I grant Mokash access to my phone?’

For starters, Mokash uses the information to determine your eligibility and limit. For example, if you’ve messages from other lenders claiming payment, the chances are that Mokash will deny you a loan.

On the flip side, if your MPESA transaction messages are impressive, they’ll likely impress Mokash, who’ll likely offer you a loan.

But still, there is the aspect of Mokash accessing your contacts and using the information against you in the future if you default to pay.

If you are not new to loan apps, you must have heard some people complaining of app agents calling their bosses, in-laws, or even pastors to claim that they are emergency contacts or guarantors of the loan that the customer took.

So, be wary of these possibilities.

Generally, here’s a list of information that Mokash requests to access on your phone:

- Contacts

- Call log

- SMS (especially MPESA SMS)

- Media files (photos and videos)

- Camera

- Phone storage

- Wi-Fi connection

- Phone ID

Mokash Loan Application (How to Get a Loan from Mokash)

It’s essential that you meet Mokash’s eligibility requirements before applying for a loan. It’s also important to first download the app and register for an account.

After that, you can go ahead to apply for the loan using these steps:

- Launch Mokash on your phone and log in using your phone number and unique password

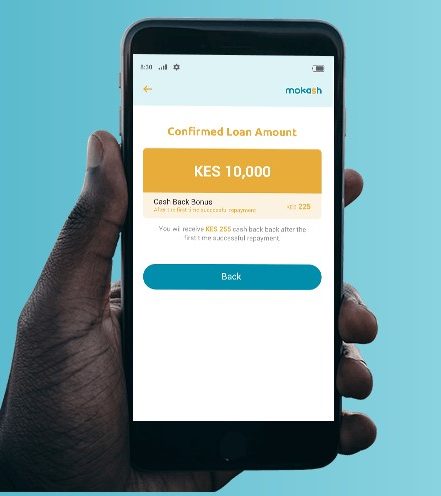

- Click done and wait for Mokash to display your eligible loan limit

- Click on Apply Now

- Wait for the amount to be sent to your MPESA in minutes

Mokash Loan Limits

Depending on your borrowing history with Mokash (if any), credit record, and MPESA dealings, Mokash can loan you Ksh 2,000 – Ksh 10,000. That’s according to the app.

However, according to customers online, Mokash can lend you up to Ksh 30,000.

Note that you are likely to start with Ksh 2,000 if you are a new customer and then grow your limit over time by paying promptly and borrowing from Mokash frequently.

Fees, Repayment Period, and Penalty

According to Mokash, all its loans don’t attract any service charge, and the maximum annual percentage rate (APR) is 36%.

And when it comes to loan repayment, Mokash offers you up to 91-365 days, according to the App.

It’s also worth noting that while Mokash exempts you from the service charge, it slaps you with a 2% penalty for late payments. So, you must try to pay before the deadline to avoid their harsh penalty.

While this information is on the app, the experience slightly differs among customers. Most customers claim that Mokash only offers 8-14 days to pay the loan back at an interest rate of 20%.

So, I guess Mokash needs to update its app to avoid confusion. But for now, we’ll stick with what the customers claim.

How to Pay Mokash Loan (Mokash Loan Repayment)

Mokash expects you to pay your loan in time using the pay bill number 402361 via MPESA.

Here are the steps to follow:

- Access MPESA on your phone and go to ‘LIpa na MPESA’

- Pick pay bill on the drop-down menu and enter the Mokash Loan App Paybill

- Input your MPESA number under account number

- Enter the figure you want to pay and then your MPESA pin

- Confirm everything before clicking Okay

Overpayment

In case of an overpayment, you can reach out to Mokash customer care, and they’ll refund the extra amount to your MPESA within 15 days.

Mokash Contact Information

Whether it’s to inquire, complain about something, or to confirm their existence, you can contact Mokash using these routes:

- Website – mokashcredit.com

- Customer care number – 0110835100

- WhatsApp – 0110835101

- Facebook – www.facebook.com/mokash

- Physical location – Kose Heights 6th Floor Argwings Kodhek Hurlingham Nairobi

- Email – info@mokash.com/ help@mokashcredit.co.ke

Is Mokash Loan App Worth It? Pros and Cons

Pros

Generally, Mokash is worth it because of these benefits:

- Higher loan limits (Ksh 2K – Ksh 30K)

- Seamless loan application

- Fast loan disbursement

- Zero service fee

- Faster app installation

- Easy to grow your limit

Cons

The biggest issue with Mokash is the fee. The fees can be too steep considering that the app charges a 20% interest and a possible 2% daily charge for late repayments.

Also, even though Mokash claims through its app that the loan repayment tenure is 91-365 days, customers claim it’s only 8-14 days. That’s pretty short!

And, of course, the biggest concern is your privacy. The fact that Mokash can use your contact list to call people you know randomly is worrying. They might call your grandma, who knows nothing about mobile loans!

Furthermore, Mokash doesn’t offer any loan extension.

People Also Ask

1. What is Mokash?

Mokash is a loan app by Mocash that allows MPESA users in Kenya to borrow Ksh 2,000 – Ksh 30,000, depending on eligibility. Mokash is available for download on Google Play, making it ideal for Android smartphone users.

2. How Do I Check My Mokash Loan Limit?

Generally, you have first to download the Mokash app and register for an account to know your limit. Usually, Mokash displays your limit whenever you log into your account, which could be anything between Ksh 2K and Ksh 30K, depending on your credit history and MPESA dealings.

3. How Do I Increase My Mokash Loan Limit?

You can increase your Mokash loan limit by:

- Paying up the loans promptly

- Keeping the app on your phone and updating it often

- Borrowing from Mokash as often as possible

- Keep the MPESA transaction messages

- Avoid getting blacklisted by other lenders

4. How Do You Repay a Mokash Loan?

All Mokash loan repayments are via the Mokash pay bill number 4023691. You need to access Lipan na MPESA on your phone’s MPESA menu and opt for the pay bill.

You’ll then need to enter the Mokash pay bill number and then your MPESA number) as the account number) and pin before pressing okay.

5. How Do I Activate My Mokash Account?

You activate your Mokash account by downloading the app, setting up your account, and accepting the terms.

Once your account is active, Mokash will send a confirmation message.

Relevant Posts:

Closing Thought:

Above is everything there is to know about the Mokash loan app. The information is current but may change in the future, especially the rates, as Mokash keeps updating their App. Hopefully, what I’ve covered will help you decide if Mokash is worth borrowing from or not.