With the current economic crisis and the high cost of living, having food on the table has become uncertain. Everyone is looking for someone to turn to. You may have heard of online lenders, and maybe you have heard about the Zash loan app.

If so, Zash, previously Kopakash, is a product of Kopakash Limited that gives instant unsecured MPESA loans starting from Ksh 500 at an annual percentage rate (APR) of 25%.

But is a Zash loan worth it? How genuine is this loan app? I will answer these questions and many more in this guide.

I will also take you through getting a loan with the app and how to repay it. So, if in need of a quick emergency loan, tag along to find out more about Zash loan.

Below is an overview of the Zash mobile loan app:

| App Download | Google Play |

| Service fee | Zero |

| Lowest loan limit | Ksh 500 |

| Highest loan limit | Ksh 50,000 |

| Interest rate | 25% APR |

| Repayment period | 91 – 365 days |

| Default penalty fee | 2% – 3% the principal amount |

| Applicant age bracket | 18 – 60 years |

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

Zash Loan App Eligibility Requirement

For you to get a loan with Zash, you must meet the following:

- Be a Kenyan citizen in Kenya with a valid national ID

- Be in the age bracket of 18 – 60 years

- Have a source of income with a monthly salary

- Own an Android smartphone with internet access

- Own a Safaricom line with an active MPESA account

Zash Loan App Download

As mentioned above, Zash loan is available to android phone users. So, if you own one, you can download the app from Google Play.

Unfortunately, the app is not available to apple phone users, and still, there is no USSD code for the Zash loan.

The Registration Process

Below are the steps to sign up for a Zash loan:

- Launch the Zash loan app on your phone

- Enter your registered Safaricom number and create a four-digit pin

- Grant Zash loan access to contacts, SMS, call log, photos, camera, Wi-Fi connections, phone storage, calendar, and Phone ID.

- Complete an application form with your names as they appear on the ID, marital status, date of birth, gender, and personal email address.

- Provide your employment history – stating if you work in a formal or informal environment, your monthly income, expected payday, name of the company you work for, and your position in the company.

- Specify your physical address (home address)

- Give names of 3 emergency contacts or guarantors and state your relationship

- Take a selfie while positioning your ID around the chest

- Lastly, agree to Zash’s loan terms and conditions to complete the signup.

How to Apply Zash Loan

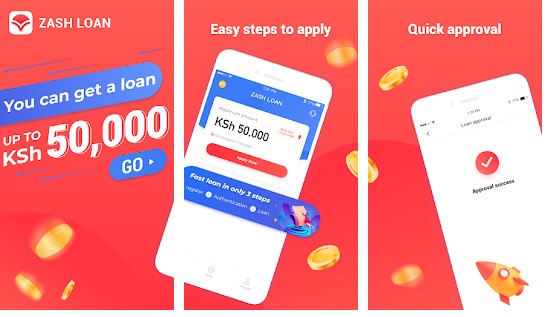

Upon successful signup, you can apply for a Zash loan by following the simple steps below:

- Log in to your Zash account

- Wait for Zash to display the amount you qualify for

- Click on the icon ‘apply now.’

- Wait for a few minutes for the loan to be disbursed to your MPESA account

Zash Loan Limits

Zash can lend you an MPESA loan starting from Ksh 500 to about Ksh 50,000, depending on your credit record and MPESA transaction history.

Of course, you are more likely to start with Ksh 500 as a new customer, and it’s likely to take time before you can draw close to the Ksh 50K mark. It takes trust for Zash to loan you a higher amount, which means paying up on time and using the app often.

Zash Loan Interest Rate

Zash only discloses its APR interest rate, which is 25% of the principal amount. According to the app, the repayment duration is 91-365 days, though some customers claim it’s 7-14 days.

How to Pay Zash Loan

Zash expects you to pay your loan back before the expiry of your repayment period. In that case, here are the steps to do it:

- Go to the MPESA menu and click on ´Lipa na MPESA´

- Choose the ‘pay bill’ option and enter the Zash Loan App Paybill 733555

- On the account number option, enter the Safaricom number you borrowed with

- Input the loan amount you want to pay

- Enter the MPESA pin, confirm the details, and then press OK

- Wait for a confirmation message from MPESA showing that your repayment was successful.

Zash has a 15-day grace period for failing to pay up on time. Nonetheless, the extension comes with an additional 2% penalty, and once the grace period ends, you may request another 15-day extension, but you’ll incur a 3% penalty this time around.

But once you fail to pay pup after the expiry of the second grace period, Zash may choose to forward your details to CRB (Credit Reference Bureau) for blacklisting.

Zash Loan Contacts

Are you having issues with the Zash loan app? Whether you want to complain or inquire something about the Zash loan app, you can reach their customer care representatives using the contacts below:

Email: cs@zashloan.com

Physical Address: One Padmore Place, George Padmore Road, Nairobi City, Kenya

Zash Loan Website: www.zashloan.com

Zash Loan App Pros and Cons

Pros

After all the information above, is the Zash loan worth it? Below are the advantages that come with instant loan app:

- Collateral or security is not necessary

- There is no paperwork required (the process is digital)

- Quick loan disbursement to MPESA

- No service fee is required to get a loan

- There is a loan repayment extension

- It’s easy to grow your loan limit with Zash

- No hidden charges

Cons

Here are, however, the concerns that come with the mobile application:

- Requires a lot of your personal information before it can lend you

- The loan limit is low compared to other loan apps

Is My Data Safe with Zash?

This is one question that always troubles people’s minds when thinking of taking an online loan. Well, I understand that too!

As Zash states on its app, personal data is safe with them. However, if you don’t pay the loan on time, Zash transfers your details for blacklisting with the CRB.

However, Zash can only use the information it gets from you against you if you default to pay the loan on time, especially after the expiry of the extensions.

So, if you are new to online loan apps, be wary of taking a loan if you are unsure of how to pay it back.

The ugly truth is that Zash can call everyone from your contact list and send them annoying messages. That includes your pastor, in-laws, boss, colleagues, or close friends. You will agree that it’s shameful. So the only way to avoid the predicament is to pay up.

People Also Ask

1. Why Was My Zash Loan Denied?

Zash may deny you a loan because of any of the following reasons:

- The information you provided was not true

- You are already listed at the Credit Rating Bureau (CRB)

- Your working status is not genuine

- You have a poor credit history

2. How Do I Repay My Zash Loan?

Repaying Zash loans is easy. You need to follow the few steps below:

- Go to MPESA on your phone

- Select Lipa Na MPESA and then enter the pay bill number 733555

- Input your Safaricom phone number as your account number

- Enter the amount you want to pay

- Enter your MPESA pin and send and that’s it

3. Is Zash Loan App Genuine?

Without a doubt, the Zash loan app is genuine. You can confirm that from the customer reviews of the app on Google Play and their website.

Also, they have a physical office at One Padmore Place, George Padmore Road, Nairobi City, Kenya. That means you can visit them physically for inquiries.

4. Who Owns the Zash Loan App?

Kopakash Limited owns the Zash mobile loan app.

5. What Will Happen If I Default Zash Loan?

If you don’t pay your Zash loan on time, the lender will give you 15 more days to repay it, but you’ll incur an extra daily penalty fee of 2%.

Once the 15 days expire and you still owe Zash, you may request another 15 days at a daily penalty of 3%. But once the extension expires, Zash may report you to CRB.

6. How Can I Increase My Zash Loan Limit?

Well, it’s easy to increase your Zash loan limit using these tips:

- Paying your Zash loan on time

- Keeping and updating the Zash app often

- Borrowing more frequently

- Keeping all your MPESA transactions

- Using mobile services like Safaricom and M PESA frequently

Also Read:

Closing Remarks!

Above are the basics of the new Zash loan app. If you think the rates and terms of the loans are favorable, you can go ahead and apply for a Zash loan.

Remember, nonetheless, that it’s more important to pay up than borrow. If you are not sure where you’ll get the money to pay back the loan, stay away from it, which will keep you away from CRB.